Vinyl and One Size Fits All Strategies Will Not Save The Music Business [Mark Mulligan]

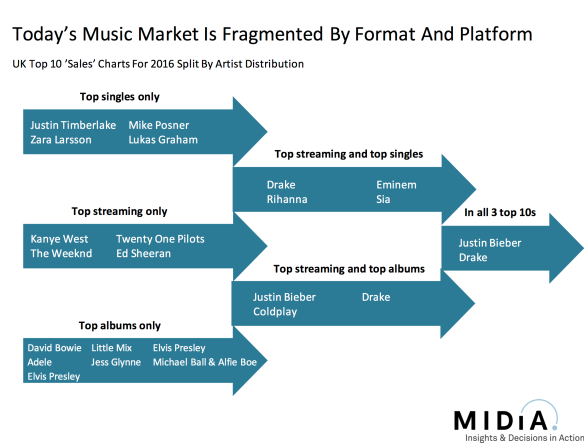

Surging vinyl sales may make a great headline, but at just 2.6% of total sales, they won't save the music business, says music industry analyst Mark Mulligan of MIDiA. The real headline should be the increasing fragmentation of the industry with little overlap between the most popular artists on the vinyl, streaming, singles and album charts.

________________________________________________

The BPI announced that ‘album equivalent sales’ were up by 1.6% in volume terms in 2016, with vinyl and streaming identified as the key drivers. Many people retain a nostalgic soft spot for vinyl, so an apparently vinyl led revival is always going to get people’s attention. But not only is vinyl not the future (it was just 2.6% of sales in 2016), the big differences between the most popular vinyl, streaming, singles and album artists reveal just how fragmented the music business has become.

Each of the top 10 charts (album sales, singles, top streaming artists, vinyl sales) almost reads as a standalone group of artists with remarkably little cross over. In fact, only 2 artists (the ubiquitous Drake and Justin Bieber) appear across streaming, singles and albums. None appear across all four charts.

The fragmentation adds complexity to an already sophisticated and nuanced landscape:

- Two tribes: Only one of the top single artists of 2016 (Justin Bieber) was also a top album artist. This is why the album vs playlist album argument will continue way beyond 2017. Both realities co-exist with one catering more towards older audiences and the other to younger ones. The top 10 albums list is like browsing through a high street music store CD rack circa 2005: Elvis Presley, David Bowie (twice), Coldplay, Michael Ball. Of course, there is some overlap with streaming, an inescapable overlap considering that streams are now (for all the wrong reasons) counted towards album sales. Thus, we see contemporary artists Little Mix, Drake and Jess Glyn fill the 7,8 and 9 slots, while Justin Bieber is at #4. But first and foremost this is a tale of 2 tribes, 2 groups of music fans whose tastes and consumption patterns rarely overlap.

- Old format, old bands: Vinyl sales may have hit their highest level in the UK since 1991 but this is hardly a sign of what is to come. Indeed, a quick look through the top 10 vinyl albums of 2016 reveals that all but one of the artists were releasing music back in 1991! The exception is Amy Winehouse and she’s dead. The majority of the volume of vinyl sales is driven by nostalgic older music fans. Of course, younger people do buy vinyl too, but interestingly they generally do so as either a form of merch or as a way of supporting their favourite artist. In fact, many under 30’s vinyl buyers don’t even have turntables.

The really important takeaway from all this though, is what it means for driving sales and marketing artists in 2017. One size stopped fitting all long ago, but now there are clearly two broad groups of music audiences which must be addressed in entirely different ways, across different channels and with different tactics. At the most base level this is a case of youth versus grey, of digital native versus digital immigrant, of playlist versus album, of sales versus consumption. But it is also more complex and nuanced than that. There are overlaps and cross pollination. They may be relatively thin on the ground right now, but like some long-lost treasure map, they may point to how bridges can be built across these two worlds. If no such links can be made then ultimately this will be a story of one world hurtling to oblivion while the other booms. That is of course the more likely scenario, highlighted by the fact that (in volume terms) UK CD sales fell by 12% and download sales by 26% in 2016 while streams were up 67%.

As large volumes of older consumers switch to streaming (and Amazon should play a key role here) there will be more opportunity to join the dots. But do not mistake this simply as an opportunity to try to revive yesterday’s formats in today’s platforms. The album is clearly fading. According to MIDiA Research survey data, 68% of subscribers state that playlists are replacing albums for them. It is time to start investing though and effort in rethinking what album experiences should be in the digital era. And that conversation should have no bounds, everything should be on the table (number of tracks, street date vs continual updates, interactivity, changing content etc.).

The 2016 sales figures show us that the album in its traditional format still has a very solid, albeit quickly declining, audience. But if it is to outlive that dwindling customer base it must be rethought for the streaming era.