________________________

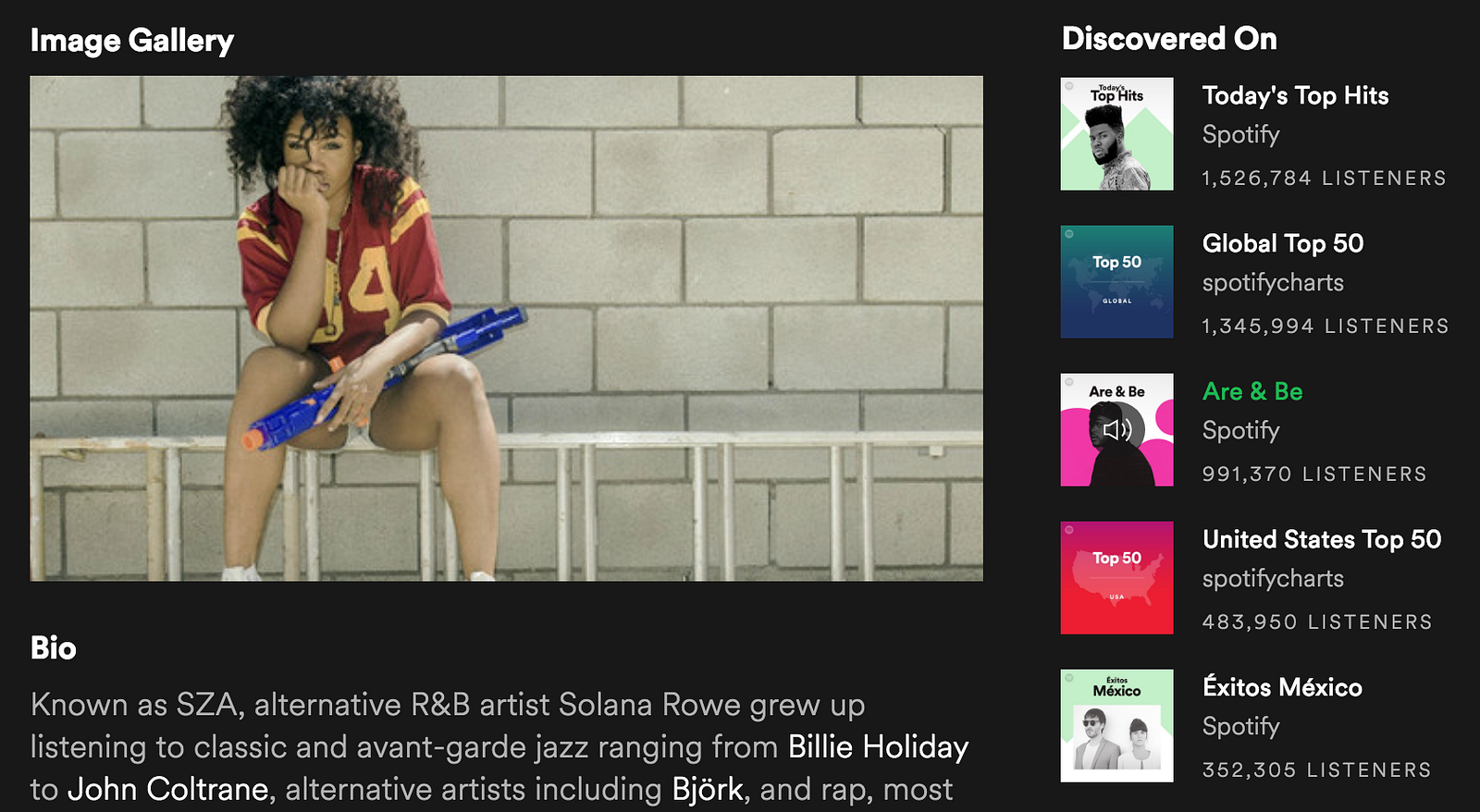

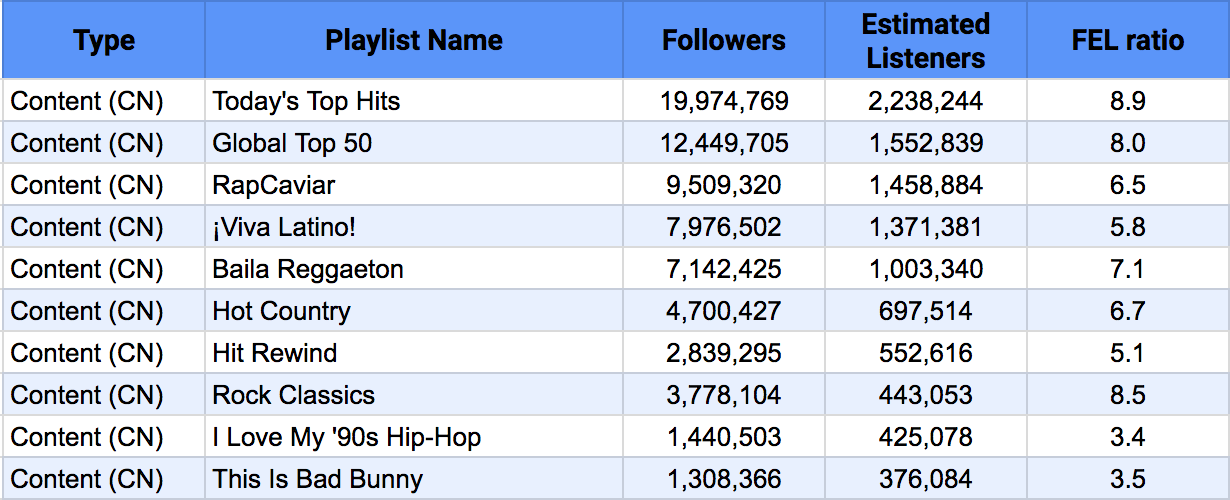

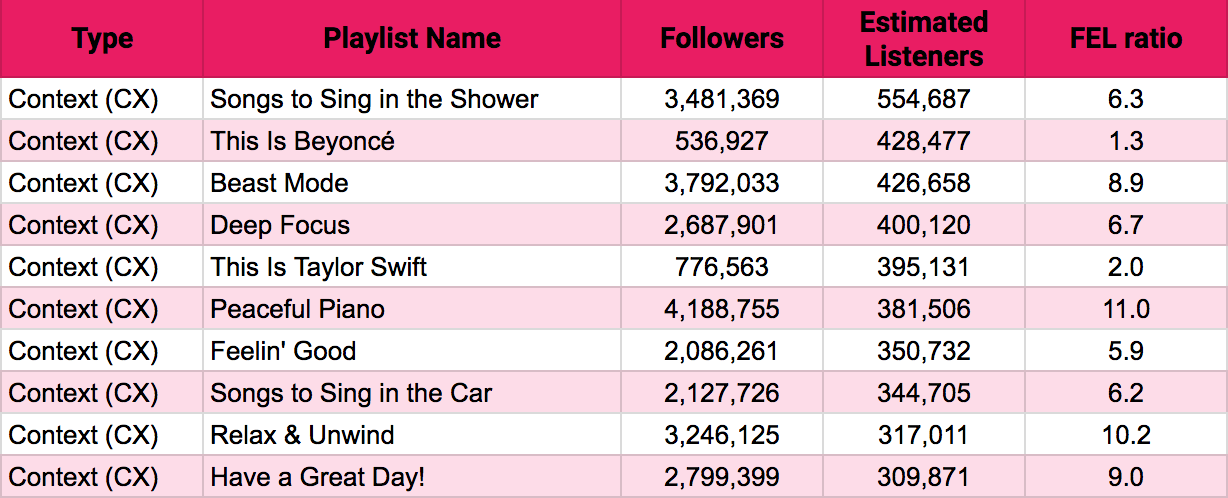

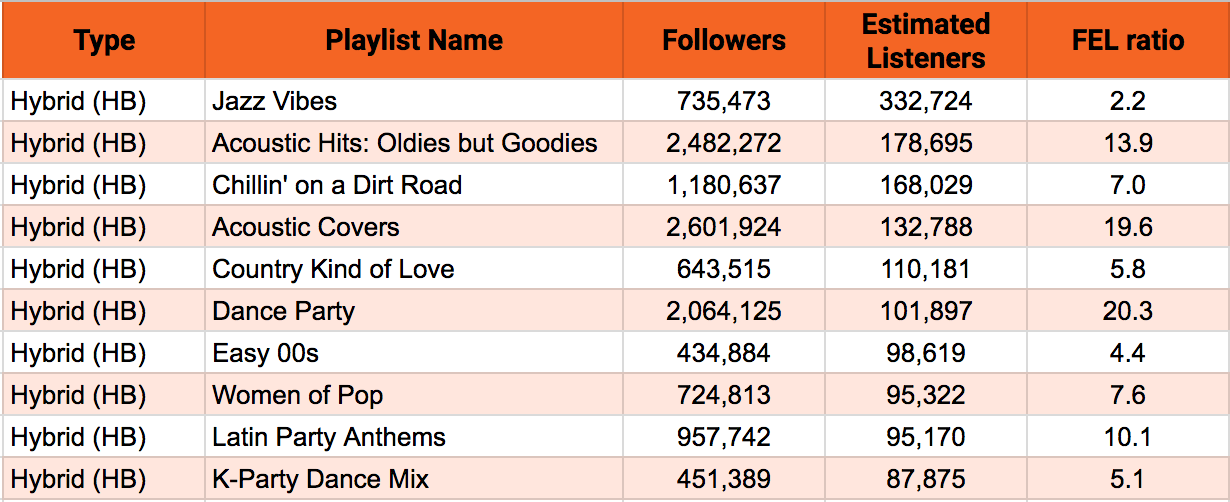

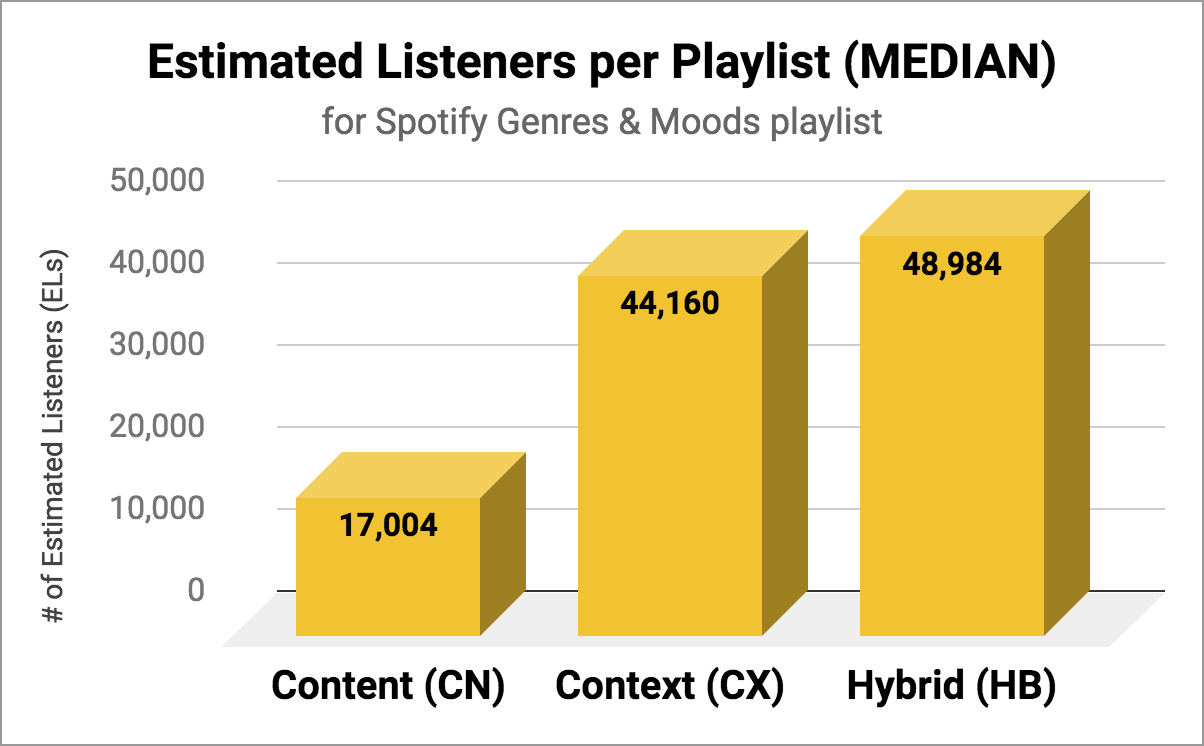

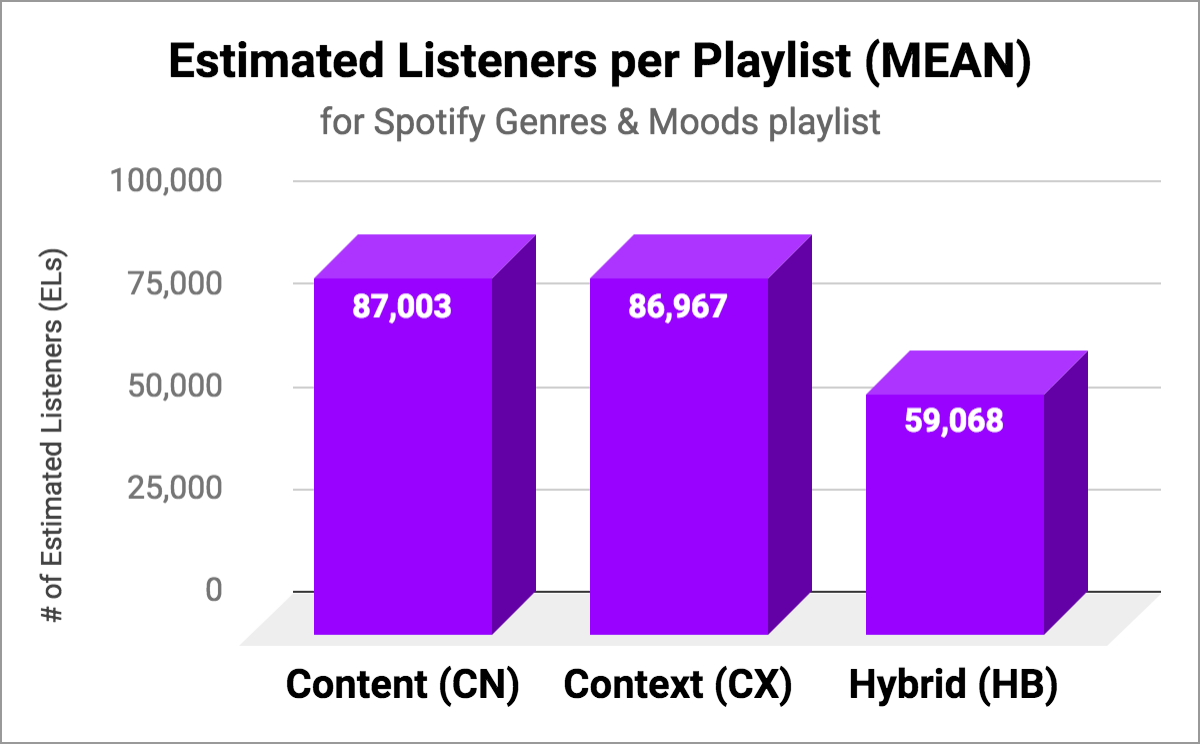

Guest post by Jason Joven of Chart MetricIn March 2018, we explored the idea of content-based (CN), context-based (CX), and hybrid (HB) playlists on the Spotify platform…if you missed it, check it out here for some context (pun fully intended).But essentially, CN playlists represented the traditional way of categorizing music (e.g., genres, countries), CX playlists focused more on the user (e.g., working out, gaming, day of the week), and HB playlists mixed both types. Of the 950+ playlists at the time from Spotify’s Genres & Moods section of their interface, CN playlists were understandably more plentiful (57%).More notably, CX and HB playlists outdid them in both median followers per playlist (HB had over 237K follows vs. CN’s 103K) and percentage follower gain since March 2017 (CX had 84% gain vs. CN’s 62%). The evidence pointed towards context being more and more of a meaningful touch point with Spotify users.In April 2018, we announced a new metric called “Estimated Listeners” (ELs) for playlists. Definitely check it out on your favorite playlist’s Chartmetric profile, and see how we engineer the feature below.Methodology

“OK…but how are estimated listeners different from followers?”

Estimated Listeners vs. Follows

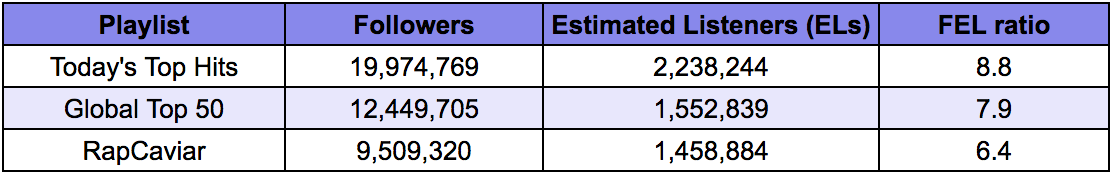

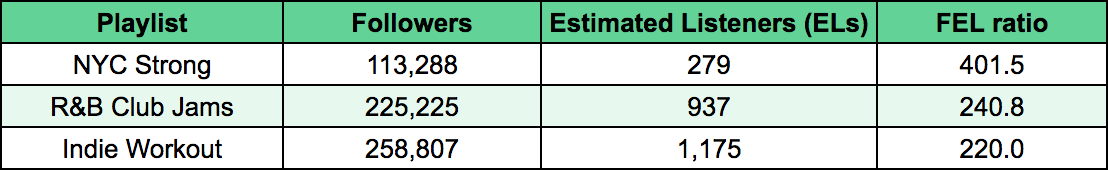

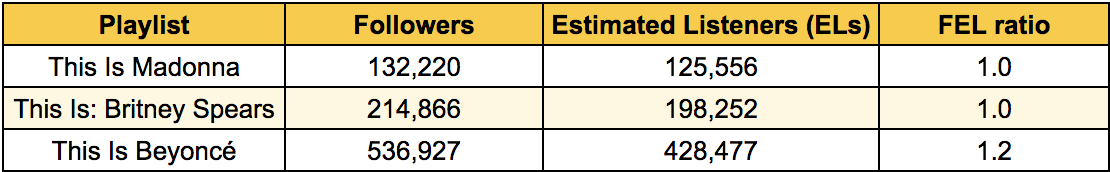

So if we’re using Estimated Listeners as our gauge of playlist “success”, how does it compare to our March 2018 article?Note we’re still building up this metric in our databases, so of the 973 Spotify Genres & Moods playlists we originally examined, we currently have a reduced sample of 416 playlists with Estimated Listeners.Additionally, one feature we can now engineer is a Follower-to-Estimated-Listener (FEL) ratio, or playlist followers divided by its estimated listeners. More simply put: “how many say they’ll listen vs. how many actually listen to this playlist?” We’ll come back to this later.

A New Playlist Engagement Metric?

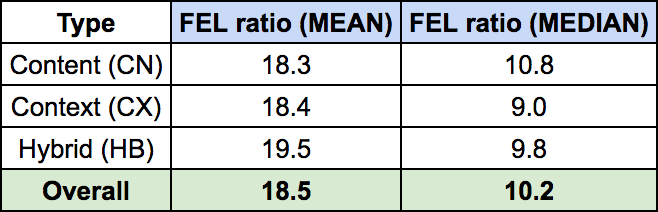

One last point: we believe the Follower-to-Estimated-Listener (FEL) ratiocould be a meaningful playlist engagement metric moving forward. Across all categories, with relatively little variation, the mean FEL ratio is 18.5 and the median FEL ratio is 10.2.Its inverse relationship with actual streaming should be made clear: the lower the FEL ratio is, the higher the engagement. A FEL ratio of 1.0 would be exemplary- a perfect 1:1 correlation saying “all followers all listen to this playlist”. A high ratio suggests that the list may seem a great idea at first to listeners, but they tend to forget about it later.

Related articles