5 media trends that are changing music sync, licensing, and clearance

As broadcast and linear tv struggle against the rise of streaming, five major trends are emerging that are reshaping how music is used, licensed, and cleared.

by Emma Griffiths from SyncTank

As our latest report, Complexities and Solutions in Music Rights Clearance, explores, clearing music for use in productions typically involves a fiendish mass of complexities.

Here, we take a look at some of the developing trends across the media and entertainment space and examine their potential impact on music licensing and clearance.

Streaming’s dominance over linear

“Linear TV and satellite is marching towards a great precipice and it will be pushed off,” exclaimed Disney CEO Bob Iger at the Code Conference last September, adding, “I can’t tell you when, but it goes away.” Earlier that year, Netflix CEO Reed Hastings predicted that linear TV would be dead in “5 to 10 years.”

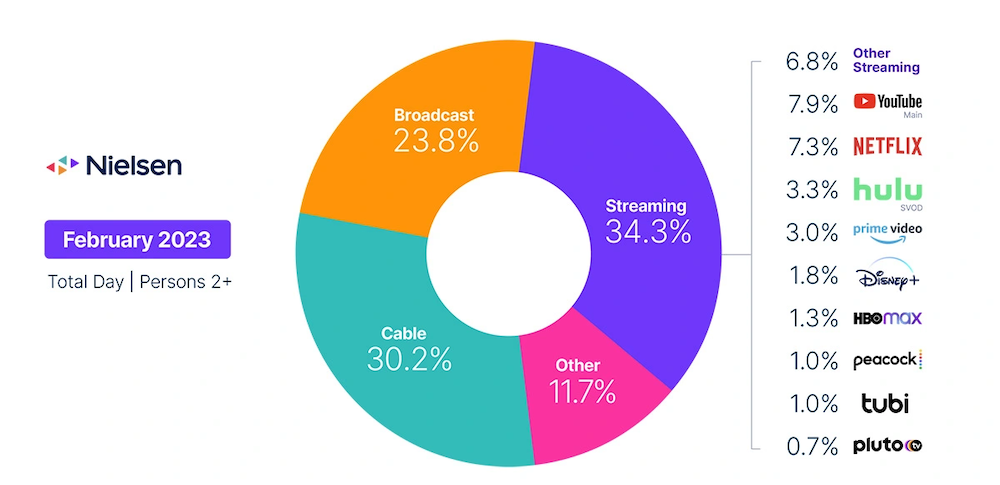

This vision for the future of television is reflected in the latest statistics from Nielsen, which show that streaming had its most competitive month ever in February 2023, accounting for a record 34.3% of overall TV usage.

For now, linear and on-demand are co-existing in the media ecosystem, but it’s clear that the latter will account for the bulk of consumption in the near future.

But what does that mean for music?

Before streaming, music rights were typically cleared on a territorial basis for certain media during a given period but, given the global and more permanent nature of on-demand, rights typically have to be cleared on a worldwide basis, for all media, and in perpetuity.

These deals are, of course, more costly and complicated to maneuver given the complexities of global licensing and could remove commercial music from the equation altogether for the majority of productions. Time is also a big factor here – in a fast moving, high volume environment, one-stop production music presents a painless alternative.

“It’s harder to get companies to agree to all media perp [in perpetuity] terms for what we see as agreeable fees, or agreeable timelines where we’re having to chase writers or chase people for approvals. We just don’t have that luxury in the same way that we used to.”

– Senior music supervisor

“It’s harder to get companies to agree to all media perp [in perpetuity] terms for what we see as agreeable fees, or agreeable timelines where we’re having to chase writers or chase people for approvals,” said one senior music supervisor interviewed for our report. “We just don’t have that luxury in the same way that we used to.”

A streaming-led future also calls into question the value of European blanket licenses. Will these agreements, designed for linear TV consumption, adapt for the streaming age or be no longer fit for purpose?

An increased focus on efficiency and cost-saving

Media companies are increasingly tightening their pursestrings in the current economic environment.

With subscription growth stalling, the focus has now shifted to user retention, efficiency, and cost-cutting, and streamers are being forced to reevaluate their business models.

In recent months we’ve seen significant job cuts across media and content spend is predicted to flatten in 2023 as companies look to do more with less.

All of this is likely to have a knock on effect for music, both from a budgetary perspective but also from a volume perspective if less new content is created.

While there will always be significant music budgets for the biggest films, TV shows, commercials and games, across the full gamut there is likely to be a further tightening of budgets, requiring music supervisors to get more even sonic bang for their bucks.

“In terms of pricing, yes, it is very challenging because, sometimes we have to compromise on rights; (for example) instead of perpetuity, cut it for a shorter term to stay on budget since synchronization fees are high,” explained one music rights executive from a US broadcaster in our report.

Keeping track of music budgets and spending will be increasingly essential in this new media environment, and music teams will be looking to optimize their deals with production music libraries and even build up their own custom in-house libraries for use internally, for monetization externally, or both.

Legacy content going further

If it feels like almost everything new is old on streaming platforms, it’s because we’re seeing more opportunity for content to be revived and repurposed across media outlets.

While ‘exclusive’ and ‘original’ content used to be the holy grail of the TV business and streamers have been singularly focused on building up their own libraries, large content owners are starting to look more at licensing to third parties.

This is all part of a strategy to spend less on new content and monetize existing content more effectively. As James L. Dolan, the interim executive chairman of AMC Networks, put it earlier this year, “Most media companies [are] beginning to course correct to better monetize content and improve the economics of their business.”

A driving factor here is the rise of FAST (free ad-supported streaming TV) platforms like Tubi and Roku, which largely offer licensed or library content at no cost to viewers. This is creating more opportunity for streamers to offload risky and expensive content rather than keeping everything in-house, and creating monetization opportunities in the process.

While repurposing content will create opportunities for music rights holders, from a licensing standpoint it certainly presents challenges. As one music rights executive from a TV network explains in our report:

“There are so many more platforms now and much more initiative, not only to create new content, but also to resurrect old content. And when we resurrect old content there may be music that is licensed and is out of term… So how do we go back with a situation like that and take next steps if the information for the original use is not readily available?”

“When we resurrect old content there may be music that is licensed and is out of term… So how do we go back with a situation like that and take next steps if the information for the original use is not readily available?”

– Music rights executive, TV network

Music supervisors often find themselves clearing music for shows before they know where they will ultimately end up. “We’re creating content that doesn’t necessarily [yet] have a distribution home. So what we’re trying to figure out is how to work best with labels and publishers and music libraries and all these different people to be able to either pre-clear stuff or find ways to remove distribution from the equation altogether,” said one supervisor we interviewed. “You really need to clear everything on a worldwide buyout basis because it can’t be renegotiated every time it switches distributors,” another added.

Tracking all of this is no simple task, particularly when access to historic documents is typically limited and teams are managing rights, licenses, and other information using spreadsheets and a host of other tools.

Sweating of IP and franchises

“Expect all major players to spend less on volume, and more on focused impact,” said media analyst Peter Csathy in his predictions for the industry in 2023. “Evergreen, ever-reprogrammable franchise content is where it’s at. Just ask Disney — Marvel, Pixar, Star Wars, The Avengers, Disney Princesses, oh my!”

Content owners will be increasingly looking to leverage already popular franchises and IP this year to deliver more return on investment. Take Paramount, for example, with its Yellowstone and Billions universes, or the aforementioned house of mouse who recently announced sequels to three of its most popular franchises, Toy Story, Frozen and Zootopia.

We’re also seeing increasing cross pollination of IP across different mediums, for example with the release of The Last of Us, HBO’s first (and likely not last) TV series based on a video game, providing a winning template for other game franchises to follow.

Similarly, Hogwarts Legacy, a video game based on the Harry Potter franchise, earned $850 million in its first two weeks, making it the biggest global launch ever for Warner Bros. Games.

It’s no secret that familiarity sells and all of this will have a positive impact for both music rights holders and music supervisors as new opportunities continue to be created and music budgets are likely to be healthy for these big brand projects.

More content across more platforms

Gone are the days when marketing a new film or TV project involved a theatrical or TV trailer and a few billboards. In today’s media landscape, getting the attention of consumers requires a myriad of approaches and a real content mix across platforms like YouTube, TikTok, Snapchat, and Instagram.

Throw in entirely new distribution channels like the metaverse and you’ve got a whole world (or several worlds!) of challenges when it comes to licensing music, particularly when different platforms operate with different rules and some don’t even have PRO licenses.

“When somebody comes to us and says ‘this show is now being sold to X, Y and Z partner’ or ‘this show is now a completely digital series that’s going to be cut in verticals for TikTok or something like that, we’re able to adapt and say ‘okay, well, these [licensing] buckets are okay for that [and] these buckets are not okay,” explained one music supervisor in our report.

“When somebody comes to us and says ‘this show is now being sold to X, Y and Z partner’ or ‘this show is now a completely digital series that’s going to be cut in verticals for TikTok or something like that, we’re able to adapt and say ‘okay, well, these [licensing] buckets are okay for that [and] these buckets are not okay.”

– Music supervisor

“For marketing, we engage with various platforms, each with its own set of possible restrictions,” said one music supervisor from a games publisher. “So navigating these situations can be pretty complex at times.”

This is clearly an area where technology has evolved faster than licensing can match it. While platforms like Facebook and TikTok do have music licenses, they are primarily focused on supporting user-generated content, rather than commercial productions and branded content.

That leaves broadcasters and production companies mulling the best approach to future proof their content, especially if they are unsure when producing it quite how it will be distributed.

While clearly beneficial for music rights holders and content creators, this proliferation of new digital platforms is creating massive headaches for those wanting to license music and track everything across all of those formats and spaces.

Emma Griffiths is the editor of Synchblog, a blog created by Synchtank to provide insight into the music and media industries. Subscribe to our weekly newsletter for the latest Synchblog posts & key industry news in your inbox each week.

Snapchat is really taking a boost. https://lookerstudio.google.com/u/0/reporting/ccdebc61-783b-4077-ab04-afe94c821b40/page/Adz7C