MusicWatch study points to continued growth but offers some surprises

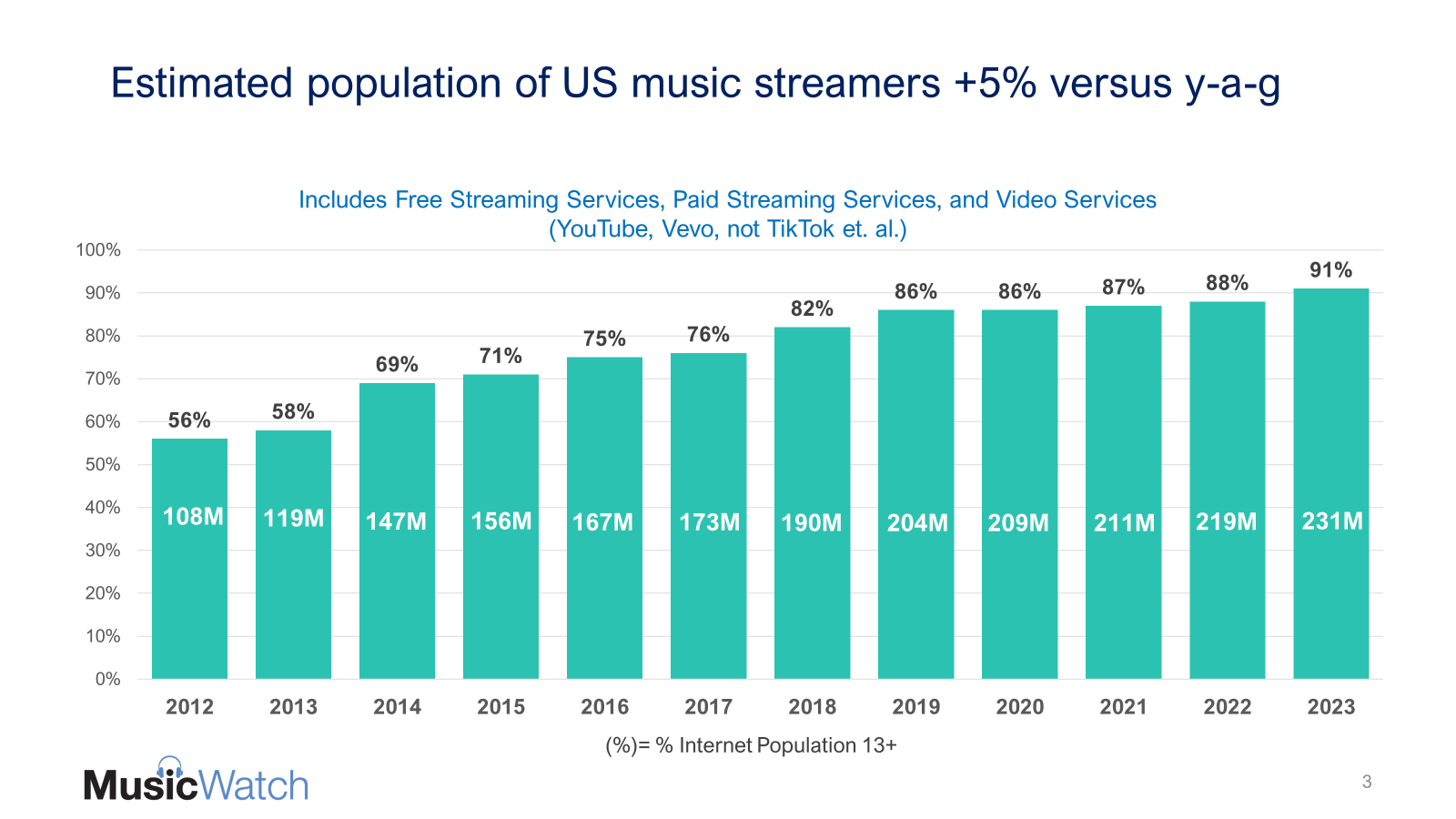

A new MusicWatch study says 90% of US internet users stream music, and consumer willingness to spend money on music points to more strong growth ahead. But there were also several surprise findings.

The industry consultancy has published the 22nd edition of the US Annual Music Study, a comprehensive overview of audio and music purchasing and listening in the US.

Some Surprises

The findings point to strong growth ahead for music as well as several less obvious trends, including an increase in broadcast radio listening, a gap between fanship and revenue generation, and the importance of high-quality audio to most users.

Here are the highlights.

1. Growing customer base. The US recorded music category continues to show healthy growth, with an increase of 10 million “buyers” in 2023. Buyers include those who purchase or pay for CDs, Vinyl Records, Digital Downloads or Music Streaming Subscriptions.

2. Increased spend. Spending on recorded music increased by 7 percent compared with year-ago, thanks to expenditures on Streaming Subscriptions, Vinyl and CDs.

3. Record numbers of paid subscribers. The number of paid music subscribers in the US hit a record, at 109M; 136M if SiriusXM and Amazon Prime music listeners are included. That means over half the population* are paying for an audio subscription.

4. More “juice to squeeze.” There is potential for additional subscription growth, though 7 of 10 Millennials already pay to subscribe. This places a premium on moving GenZ from free to paid services and converting the older and more resistant demographic.

5. The Walkman dream realized. The top reason for music streaming is the ability to listen to music anyplace and anywhere. Connectivity resonated as a key theme motivating subscribers.

6. Happy Birthday, Hip-Hop. In 2023, Hip-Hop (finally) passed Classic Rock as America’s favorite genre, as measured by what we listen to, follow on social media, purchase, interact with on streaming services, or spend money on live events.

7. Content opportunities abound. Eighty percent of streamers regularly listen to audio categories besides music. Comedy, current events, and podcasts closely compete for the #2 spot.

8. Will the vinyl revolution continue? Nearly nine of ten vinyl buyers plan to buy more or the same number of records in 2024.

9. End of the trend coming? The TikTok juggernaut continued in 2023, with 8 percent more users engaging in music-based activities on the platform. Social video accounted for an increasing share of music listening time.

10. Dialing in. Music on broadcast radio, while not the powerhouse it once was, gained listeners in 2023 and continues to be the #1 in-car listening option- used by 69% of in-car listeners.

11. Pirate ships are sinking. Music piracy continues to dampen, with fewer users getting files from mobile apps, stream ripping, file transfers, and P2P networks. The sharing of streaming accounts is also in decline.

12. Superfan gap? One in five (about 50 million) consider themselves superfans for their favorite artists. Yet, only 9% of these elite fans purchased a VIP package created by artists for fans (VIP live experience, exclusive CDs, vinyl or merch). Meaning there’s an opportunity to close the gap between fanship and revenue generation. The good news is that half these superfans are active spenders. They bought CDs, vinyl, download, merch or tickets to live events at stadiums or festivals within the past year.

13. Remember the future! Streamers are interested in many potential capabilities, from AI to gaming integration and real-time live streams. One of the top features remains high-resolution sound quality.

One in three streamers strongly agree with all three of the following:

- Obtaining the best quality sound is important.

- They would like to stream or buy more in hi-res or immersive formats.

- They would be willing to pay more for hi-res sound quality.

Methodology

The MusicWatch Annual Music Study is compiled from two surveys. The core AMS study is conducted online among 4,000 respondents, weighted and projected to represent the US internet population aged 13 and older. Audiocensus is a separate study of 3,000 and is the longest-running US survey of music and audio time spent listening.

Bruce Houghton is the Founder and Editor of Hypebot, a Senior Advisor at Bandsintown, President of the Skyline Artists Agency, and a Berklee College Of Music professor.