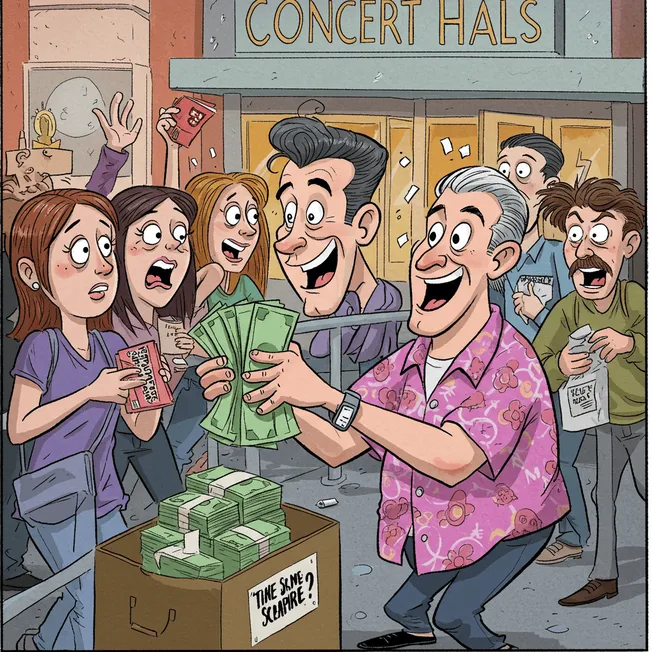

Chris Castle on how ticket and scalper financing inflates prices and make it harder for real fans to buy. As resellers get millions in credit to hoard tickets, fans are left paying more – or missing out entirely.

How Ticket & Scalper Financing Inflates Prices and Excludes Fans

Op-ed by CHRIS CASTLE via Music Tech Policy

This is getting ridiculous.

Have you ever wondered why it’s so hard to buy tickets at face price? The answer often lies in an unseen financial engine fueling the ticket resellers: scalper loans and bulk ticket financing for professional resellers.

It’s actually worse than it looks. Recent data highlights a notable trend toward an increasing reliance on financing options to purchase concert tickets.

In 2025, 60% of Coachella attendees used payment plans to purchase tickets, effectively taking out microloans to attend. Between May 2024 and April 2025, U.S. credit card holders spent an average of $300/month on live events. A generational snapshot revealed that Gen Z spent an average of $2,100 over two years on concert tickets, with nearly 20% admitting they spent more than they could afford.

Though an exact figure is not available, these trends suggest piles of money, possibly billions of dollars, are likely loaned annually to fans specifically for concert-related purchases. The intersection of live events and accessible credit products has created a consumer spending phenomenon with potential financial risk implications.

A good chunk of cash involves B2B financing flows into the resale market, allowing brokers to finance ticket hoarding long before genuine fans can click “buy.” These aren’t consumer loans — this is sophisticated business‑to‑business (B2B) lending tailored for the biggest resale operators.

Veteran artist manager Randy Nichols has pointed out that TicketNetwork, run by Don Vaccaro, is closely tied to RCN Capital, a real estate lending company that offers secured and unsecured loans for bulk ticket acquisitions. (See Randy’s comment to DOJ/FTC Comment ATR‑2025‑0002‑0074).

Meanwhile, Anytickets pushes a $40 million line of credit from Bank of America, making it seamless for brokers to fund massive buys–at least relative to fan buying power. Other financiers, like Crestmont Capital, target ticket resellers with working capital loans, promising “minimal paperwork” and “bad credit okay” — providing almost instantaneous liquidity.

These financing pipelines operate like a fuel injected supercharger — an endless supply of funding for an endlessly rising ticket market. By guaranteeing access to cash within 24 hours, financiers remove the constraints that would otherwise govern pricing and availability, allowing scalpers to dominate onsales and outbid genuine fans.

WHAT THIS MEANS FOR FANS: Scalper Financing Inflates Prices

- Scalping has evolved into an institutional, high‑finance enterprise.

- Well‑financed resellers can snap up tickets instantly, forcing fans to pay more or miss out.

- The traditional live entertainment experience — built on a social contract between artists and their audiences — is increasingly replaced by a commodity‑driven, investor‑backed marketplace.

SOLUTIONS TO CONSIDER

To restore fairness and accessibility to the ticketing market, policymakers and regulators could:

- Mandate disclosure of financing relationships: Require ticket resellers and brokers to publicly report lines of credit, loans, and other financing used to obtain tickets.

- Ban speculative tickets and prohibit loans for speculative tickets (because they’ll do it anyway): Ban spec tickets outright, and impose restrictions or caps on loans used for acquiring tickets that do not yet exist.

- Enforce the BOTS Act and expand its scope: Strictly enforce the BOTS Act and consider extending its penalties to cover financing practices that enable bot‑driven or speculative sales.

- Enforce Wire Fraud and RICO Prosecutions: Where applicable.

- Create a federal ticket resale registry: Establish a registry for resellers and their financing sources, making it easier for the DOJ and FTC to spot anticompetitive or fraudulent behavior.

- Leverage state enforcement: Encourage state attorneys general to pursue enforcement under state consumer protection and unfair trade practice laws, using the DOJ and FTC findings as a roadmap.

WHAT YOU CAN DO

If this freaks you out, too, make your voice heard. Right now, you can submit a comment to the DOJ and FTC, deadline July 7.