UK Live Music Industry: A Year of Growth and Growing Pains

The LIVE (Live music Industry Venues & Entertainment) group, which represents a coalition of trade bodies across the UK’s live music ecosystem — from promoters and festivals to managers, venues, and production crews — has published its Annual Report & Economic Highlights 2024. Drawing on data from more than 55,000 concerts and festivals, the report offers one of the clearest pictures yet of how live music fuels both the UK economy and its cultural identity.

The findings reveal a year of record-breaking growth for stadiums and arenas, but also intensifying strain at the grassroots level, where smaller venues and festivals continue to face existential challenges.

“In 2024, there was a live gig somewhere in the UK every 137 seconds.”

Record Revenues and Global Outperformance

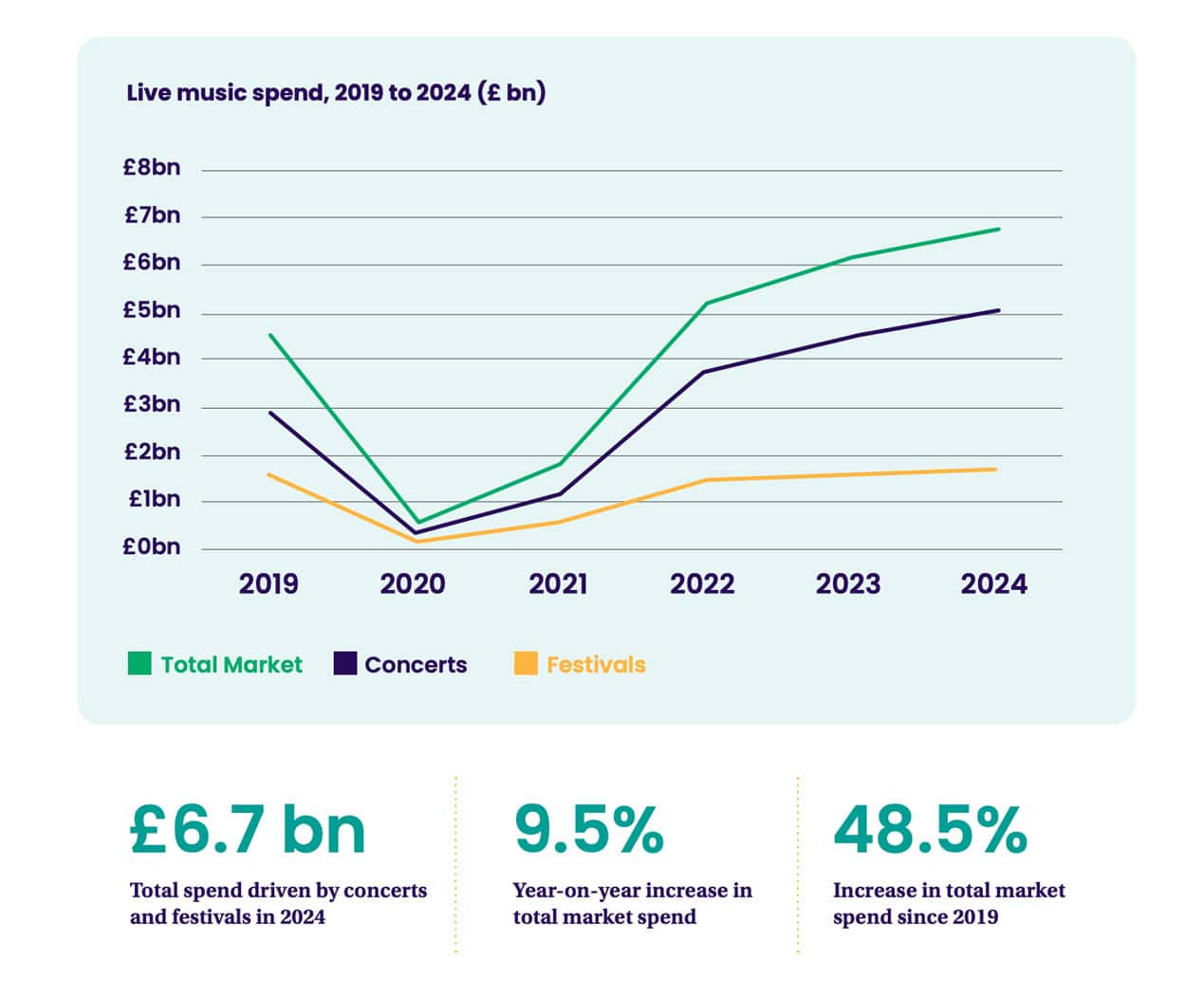

According to the report, consumer spend on live music reached an unprecedented £6.68 billion — up 9.5% year-on-year and 28.2% higher than 2022. That figure puts the sector not only well above pre-pandemic levels, but also outpacing the global recorded music business, which grew by just 4.8% in the same period (Goldman Sachs).

Concerts were the main engine of this growth. With demand fueled by an extraordinary calendar of major tours, concert revenues climbed 12.2%, accounting for three-quarters of all live music spend. Festivals, in contrast, saw only modest growth of 1.9%, as high costs and inflation left organizers with little room to maneuver. Still, the festival market has now surpassed 2019 levels, offering cautious optimism for the years ahead.

A Cultural Juggernaut

The economic story is matched by live music’s cultural pull. 23.5 million music tourists — domestic and international — flocked to UK concerts and festivals in 2024. According to The Guardian, Taylor Swift’s Eras Tour became a phenomenon, estimated to have added £1 billion to the UK economy. Other major names, from Charli XCX to Bruce Springsteen, Dua Lipa, and Sam Fender, turned cities into destination hubs, while the announcement of Oasis’s reunion triggered ticketing demand on an almost unprecedented scale.

PRS for Music data captured the sheer scale of activity: In 2024, there was a live gig somewhere in the UK every 137 seconds. From stadiums to grassroots clubs, live music proved itself not only as entertainment but as a cultural force binding communities together.

Winners and Losers Across the Map

Geographically, London remains the capital of UK live music, drawing 28.9% of all spend and an even larger share of concert revenues. Yet Manchester (8.1%) and Glasgow (5.7%) strengthened their positions, the former boosted by the opening of the Co-op Live arena. Festivals, meanwhile, delivered a bigger slice of revenue to rural economies, particularly in Central and South West England.

Genre trends further illustrate where growth is happening. Pop dominated with 32.1% of spending, more than indie and rock combined, reflecting the sheer weight of stadium pop tours. Electronic, alt-rock, folk, and classical music all carved out meaningful shares, while Latin artists gained traction across multiple genres.

“Talent is everywhere, opportunity is not.”

Employment and the Freelance Reality

Behind the numbers lies an enormous workforce. Live music supported 234,630 jobs in 2024, up 2.2% from the year before and nearly 12% higher than in 2019. Four in five of those jobs are casual, reflecting a post-COVID shift towards freelance, temporary, and agency roles.

A dedicated Powered by Freelancers study highlighted both the opportunities and the precarity of this workforce. While 73% of freelancers said live music is a great industry to work in, over half reported difficulties accessing work, and many faced last-minute cancellations without contracts. Younger workers and women reported greater insecurity, pointing to ongoing challenges around equity and inclusion.

The Grassroots Crisis

For all the headlines about record revenues, the report is clear: grassroots music is in crisis. Rising costs and limited pricing power have squeezed small venues, promoters, and festivals. In 2024, 78 festivals were forced to close. Many smaller venues kept going only through sheer passion and sacrifice.

The industry’s answer has been the creation of the LIVE Trust, a new charity funded by a voluntary £1 per ticket levy on arena and stadium shows over 5,000 capacity. The Trust’s mission is to redistribute resources from the biggest events to grassroots venues, artists, and promoters — in hopes of stabilizing the foundations of the live ecosystem without waiting for government intervention.

Policy Shifts and Industry Advocacy

2024 also brought political change. With Labour’s return to power, LIVE has pushed for progress on long-running issues such as EU touring restrictions and ticket touting. Early commitments have been secured, but the report stresses that implementation will be key.

LIVE’s working groups also advanced agendas on sustainability (including net zero by 2030 initiatives), workforce wellbeing, and diversity, showing that the sector is trying to build resilience even as economic headwinds persist.

Two Stories in One Industry

Taken together, the report paints a picture of an industry both triumphant and vulnerable. At the top end, live music has never been bigger, delivering billions in economic value and global cultural capital. But at the grassroots, closures and cancellations risk hollowing out the very pipeline that feeds tomorrow’s headline acts.

As Jon Collins, CEO of LIVE, puts it: “Talent is everywhere, opportunity is not.” Protecting that opportunity — from local venues to global tours — will determine whether the UK’s live music ecosystem remains the envy of the world in the decade ahead.