_________________________________________

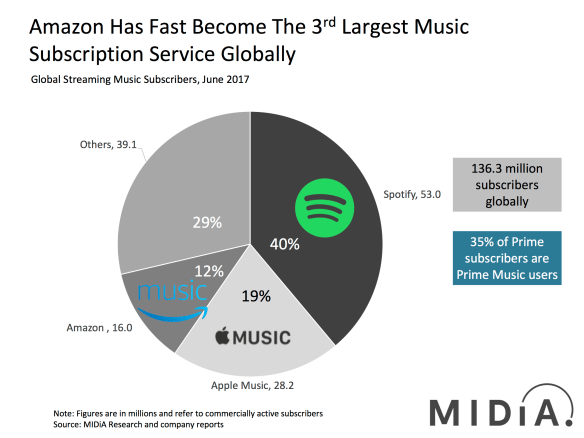

Guest post by Mark Mulligan of MIDiA and the Music Industry BlogAt MIDiA we have long argued that Amazon is the dark horse of streaming music. That horse is not looking so dark anymore. We’ve been tracking weekly usage of streaming music apps on a quarterly basis since 2016 and we’ve seen Amazon growing strongly quarter upon quarter. To the extent that Amazon Music is now the 2nd most widely used streaming music app, 2nd only to Spotify which benefits from a large installed base of free users to boost its numbers. So, in terms of pure subscription services, Amazon has the largest installed base of weekly active users.But it’s not just in terms of active users that Amazon is making such headway. It is racking up subscribers too. Based on conversations with rights holders and other industry executives we can confirm that Amazon is now the 3rd largest subscription service. Amazon has around 16 million music subscribers (ie users of Amazon Prime Music and also Amazon Music Unlimited subscribers). This puts it significantly ahead of 4th and 5th placed players QQ Music and Deezer and gives it a global market share of 12%.

Related articles