________________________

By Mark Mulligan of MiDiA and the Music Industry BlogTuesday’s media scrum around Spotify’s financials illustrate that whatever ground Apple and Tidal may have made in recent months, Spotify clearly remains the poster child / bellwether for streaming. The stories oscillated between the broken nature of the underlying economics to how streaming is the future of the music business. Both are true. But a closer look at the numbers reveal some even more important findings.

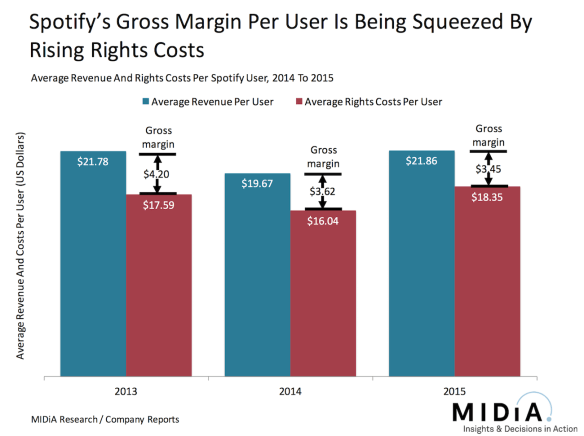

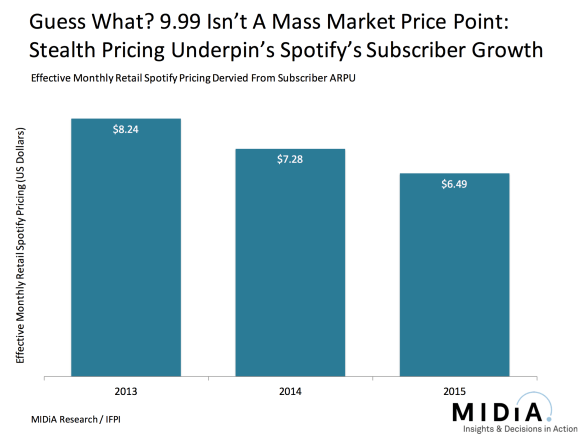

- Discounted promotions: Promos such as the £0.99 for 3 months have supercharged Spotify’s growth for the last 18 months. But as labels only contribute part of the cost this means that Spotify loses more margin with every new promo user

- Advanced label payments: When Spotify strikes its licensing deals with labels it makes advanced payments and guarantees based on its expected growth. This means that for a growth stage company like Spotify, booked rights costs will always be higher than current booked revenue. This has obvious cash flow implications. Also, should Spotify’s growth slow and it miss those targets, it will still have to pay the monies guaranteed to labels, at which point the rights costs share will rise even further

- Publisher rates: Over the last couple of years, music publishers have been asserting their role in the digital music value chain, pushing for more equitable rates. The net result is that publishing rights costs can now range up to 15%, depending on the deal, up from a low of 10% in some cases. This upward momentum will continue, and as labels aren’t decreasing their rates, it means less margin for Spotify and other streaming services

Related articles