___________________________________________

Guest post by Mark Mulligan of MIDiA Reseach

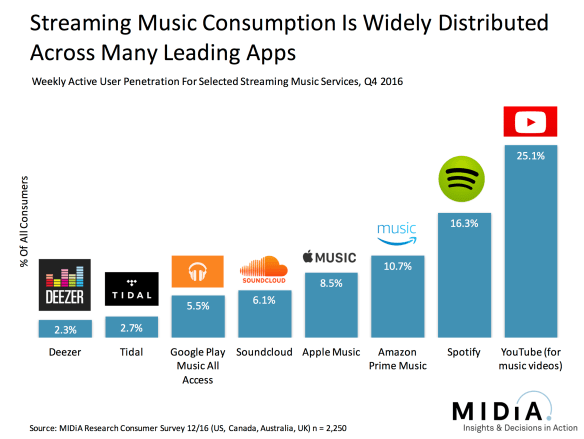

At MIDiA Research we are currently in the final stages of producing the update to our annual landmark report: The State Of The Streaming Nation, a report which compiles every streaming market data point you could possibly need.In advance of its release in June we want to give you a sneak peak into a couple of the key areas of focus: streaming app usage and major label streaming revenue.

The growth continued in Q1 2017, albeit at a slightly slower rate. Among the major labels, streaming revenue grew by 35% to reach $1.1 billion in Q1 2017, up from $0.8 billion in Q1 2016. The major labels respective share of cumulative revenue in streaming largely reflects that of total revenue. Streaming was the lynchpin of 2016’s growth and will be even more important in 2017.Streaming represented 33% of major label revenue in 2016. That share rose to 42% in Q1 2017. Streaming is now the stand out revenue source, far outstripping physical’s $0.6 billion. Though a degree of seasonality needs to be considered, the streaming trajectory is clear. Record labels are now becoming streaming businesses. The independent label sector experienced strong streaming growth also, powered in part by licensing body Merlin. Merlin paid out $300m to its independent label members over the last 12 months, leading up to April 2017, to an increase of 800% on the $36m it paid out in 2012. The streaming business is no longer simply about the likes of Spotify and Apple Music, it is the future of the labels too.These findings and data are just a tiny portion of the State Of The Streaming Nation II report that will additionally include data such as: streaming behaviour, YouTube, role of trials and family plans, playlist trends, average tracks streamed, subscriber numbers for all leading music services, service availability, pricing and product availability, revenue forecasts and user forecasts. The report includes data for more than 20 countries across the Americas, Europe and Asia and forecasts to 2025.To reserve your copy email Stephen@midiaresearch.com

The growth continued in Q1 2017, albeit at a slightly slower rate. Among the major labels, streaming revenue grew by 35% to reach $1.1 billion in Q1 2017, up from $0.8 billion in Q1 2016. The major labels respective share of cumulative revenue in streaming largely reflects that of total revenue. Streaming was the lynchpin of 2016’s growth and will be even more important in 2017.Streaming represented 33% of major label revenue in 2016. That share rose to 42% in Q1 2017. Streaming is now the stand out revenue source, far outstripping physical’s $0.6 billion. Though a degree of seasonality needs to be considered, the streaming trajectory is clear. Record labels are now becoming streaming businesses. The independent label sector experienced strong streaming growth also, powered in part by licensing body Merlin. Merlin paid out $300m to its independent label members over the last 12 months, leading up to April 2017, to an increase of 800% on the $36m it paid out in 2012. The streaming business is no longer simply about the likes of Spotify and Apple Music, it is the future of the labels too.These findings and data are just a tiny portion of the State Of The Streaming Nation II report that will additionally include data such as: streaming behaviour, YouTube, role of trials and family plans, playlist trends, average tracks streamed, subscriber numbers for all leading music services, service availability, pricing and product availability, revenue forecasts and user forecasts. The report includes data for more than 20 countries across the Americas, Europe and Asia and forecasts to 2025.To reserve your copy email Stephen@midiaresearch.comRelated articles