How Data Can Unlock Music Catalog Valuations

By Robert Steiner of Spotlight by Luminate

How can a $120 million price tag be assigned to the catalog of a band that isn’t exactly a household name outside of its rabid fan base in the nu metal music scene?

Calculating valuations like the hefty sum Slipknot is reportedly fetching from HarbourView Equity can be a tricky proposition in the bustling music rights market.

Luminate’s latest special report, Music Rights & Catalog Acquisitions, assesses the modern-day catalog market, including the vital role music consumption data plays in determining the value of a given oeuvre.

To be clear, music catalog valuations are intensive endeavors involving numerous experts with their own confidential procedures. But Luminate data can help assess factors like a catalog’s streaming performance, fan habits and genre trends, which are all crucial for determining value.

Given that streaming is the primary income source for most rights holders, streaming data is vital for evaluating a given artist or catalog. In Slipknot’s case, the band reached 2.2 billion global On-Demand Audio (ODA) streams in 2024. That’s a 15% increase from 2023 (1.9 billion) and double that of 2020 (1.1 billion).

Not only is that a clear sign of solid long-term growth, but since streaming payouts are based on share, we can assume Slipknot’s streaming revenue growth increased at a faster rate than the industry. For context, global industry revenue from streaming grew only about 7% from 2023 to 2024, per the IFPI.

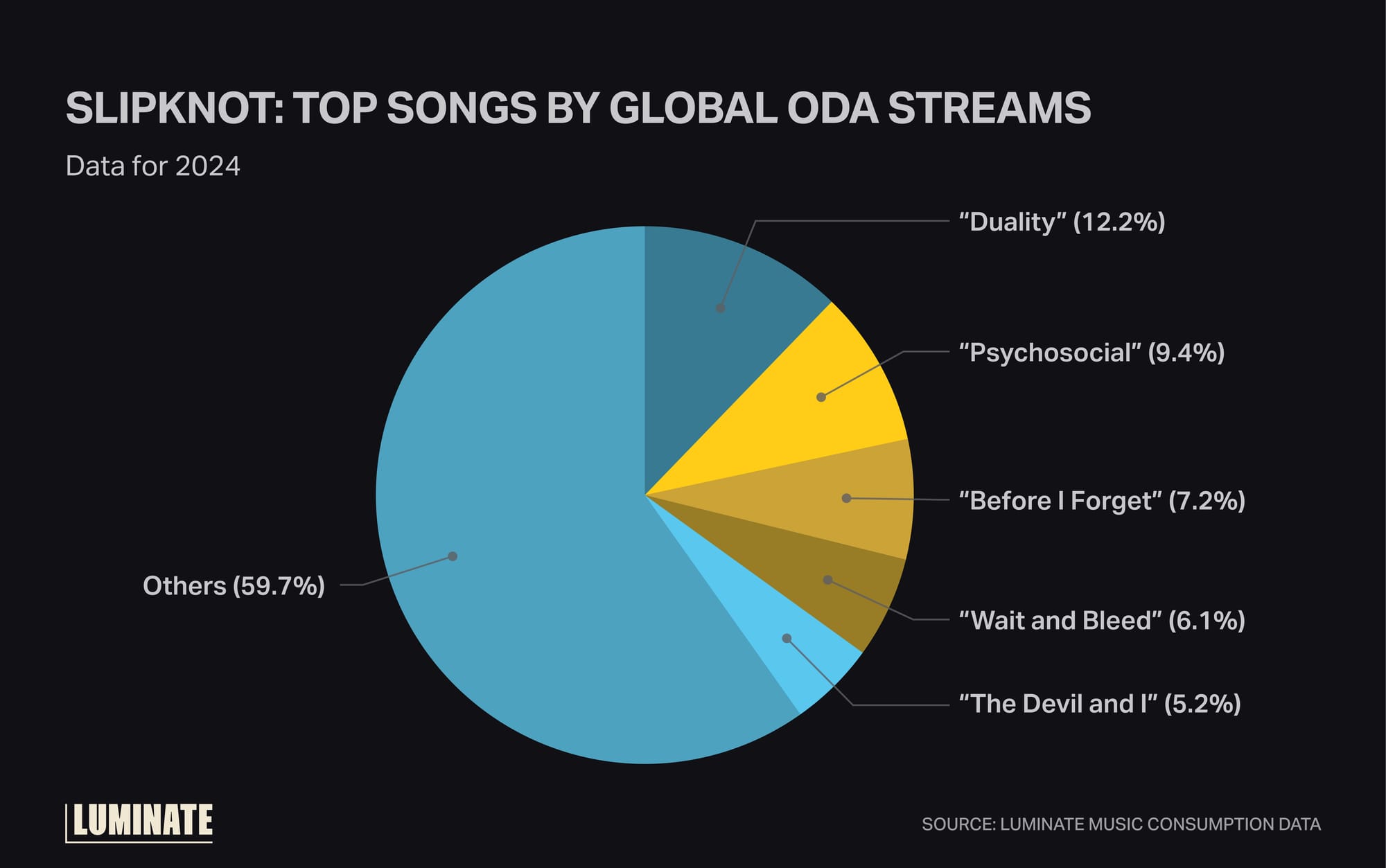

Another key factor that would be appealing to buyers is the fact that Slipknot’s streams are well distributed across the band’s discography rather than derived from just the top handful of hits.

Only its most-listened-to track, “Duality,” was responsible for over 10% of Slipknot’s 2024 global streams. For comparison, fellow ’90s metal band System of a Down saw a similar global ODA streams total in 2024 (2.7 billion), but the group’s top five tracks were below around 55% of that total.

Catalog sales often include rights for name, image and likeness. We don’t know if Slipknot’s NIL rights are on the table, but it does beg the question: How would one exploit a provocative and proudly non-mainstream brand like the one Slipknot has intentionally built?

The band obviously has fans, but from its aggressive sound to the iconic horror movie-inspired masks the nine members wear onstage, it’s not a stretch to say Slipknot isn’t as accessible as some rock acts that closed massive catalog deals, including Queen or Pink Floyd.

But as HarbourView is probably aware, the last thing it should do is water down the Slipknot brand for mass appeal. Investors are buying into a fanbase — affectionately known as “Maggots” — that’s considered one of the most dedicated followings in rock. Its look and sound not being mainstream doesn’t really matter when there are fans who share a deep emotional connection to the band and their music.

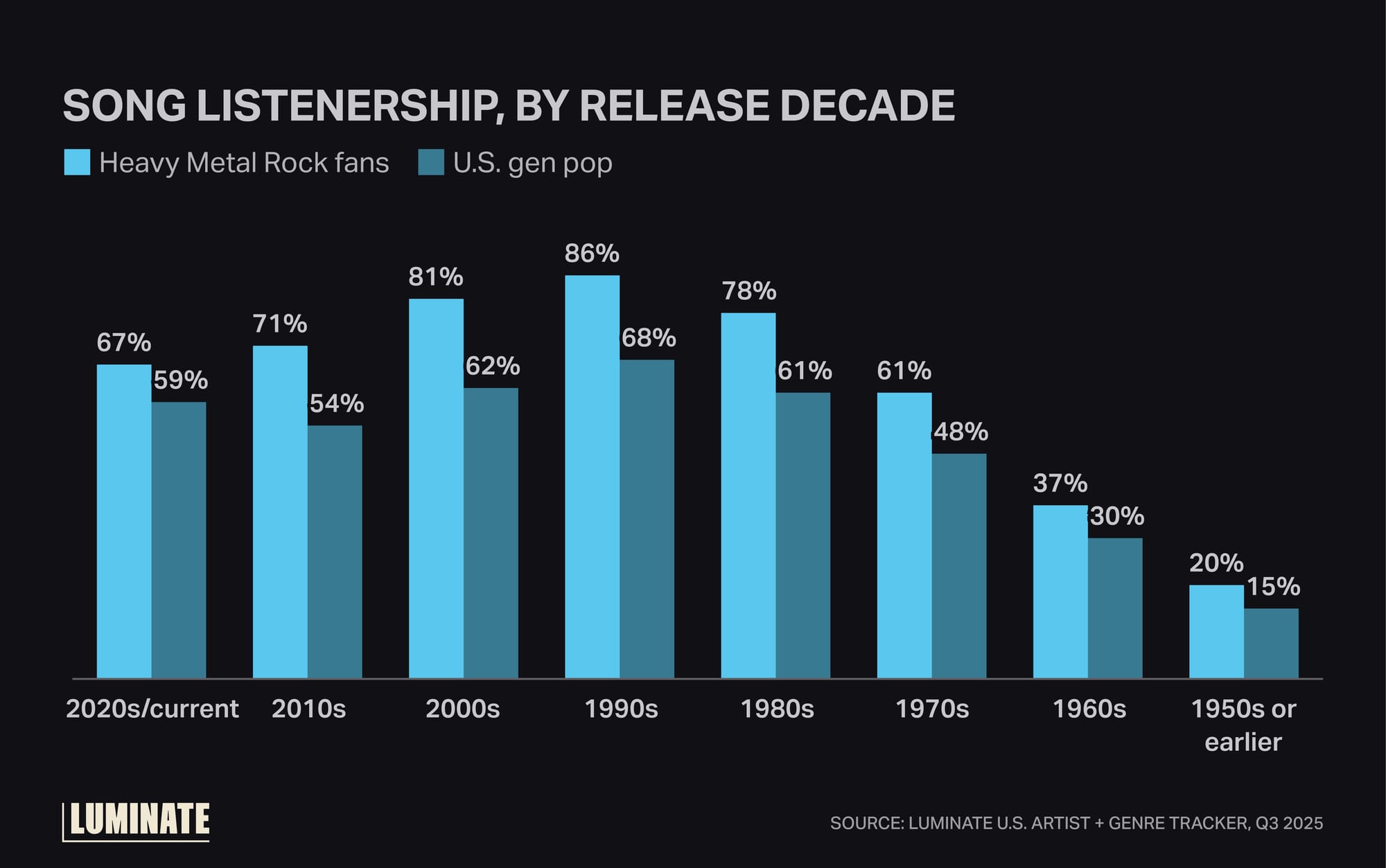

Such a long-term cult following is a powerful force, especially as the music industry continues to lean into “Superfans.” And their genre seems to inspire a higher level of fan dedication: Luminate’s U.S. Artist + Genre Tracker found that fans of heavy metal rock spend an average of 60 hours a month listening to music (versus the U.S. general population’s 44 hours).

Additionally, 86% of metalheads specifically listened to music from the ’90s — 18% higher than U.S. gen pop.

These trends help to explain why the masked men of Slipknot are so popular among metal fans, and it likely gives their catalog investors confidence in having long-term returns. Music Rights & Catalog Acquisitions is your gateway to learning more about the booming catalog market.

Spotlight is a publication by Luminate Data. Sign up for Luminate’s newsletter to get data-driven insights and case studies delivered to your inbox.