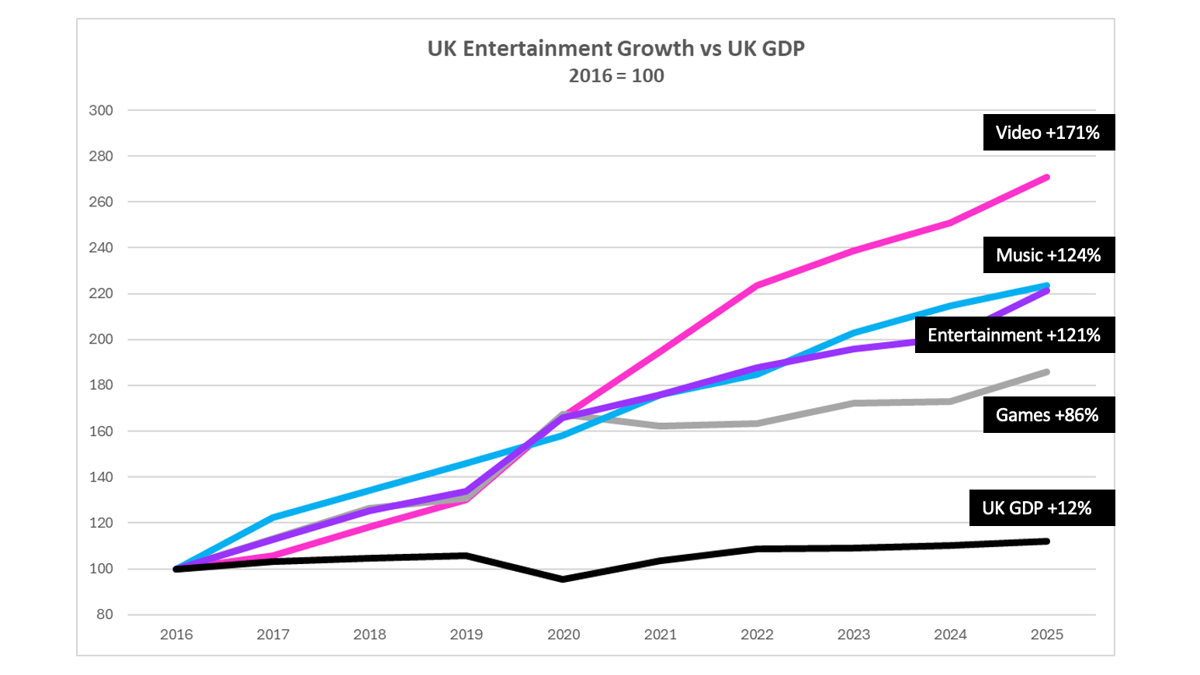

According to new data provided by Entertainment Retailers Association (or, ERA), the UK music industry posted solid growth in 2025, with consumer spending and streaming figures hitting new heights. However, this growth is also met with signs that the pace of growth has slowed, and the reality that many artists are still struggling to make ends meet.

Let’s break it down.

Key Takeaways From the Latest Data

🔹 Overall music revenue rose in 2025

Total recorded music spending climbed about 4.2% year-on-year to roughly £2.45 billion, according to interim figures from the Entertainment Retailers Association (ERA). That helped push the broader entertainment sector — which also includes video and gaming — to a record £13.3 billion in UK consumer spending.

🔹 Streaming remains dominant but slowing

UK audio streams surpassed 210 billion in 2025, the first time the 200 billion mark has been broken — but year-on-year growth decelerated to around 5.5%, down from double-digit growth in previous years.

🔹 Physical formats buck the digital trend

While downloads declined, physical music formats saw double-digit gains. Vinyl sales grew, and physical music drove an 11.5% rise in that segment — a rare bright spot in an industry dominated by streaming.

🔹 Streaming subscription income still powerful

Subscription revenue surpassed the £2 billion mark again, underlining that paid listening is the main engine of recorded music revenue despite slowing growth.

🔹 British artists fuel consumption peaks

Breakout UK talents played a key role in pushing engagement and sales higher. Viral tracks by homegrown acts helped drive music to record >>content levels amid strong support from streaming and physical sales initiatives.

However, the picture isn’t uniformly rosy.

So Why Are Artists Still Struggling?

Many artists continue to feel locked out of fair returns. Despite increased spending on music, independent and grassroots artists continue to struggle financially — with many earning modest incomes and touring costs rising steeply. Data from industry surveys show average musician earnings remain low, and grassroots venues are closing at an alarming rate.

Secondly, the grassroots ecosystem is largely still under pressure. The closure of over 125 independent venues, rising costs for tours and recording, and difficulties converting online engagement into reliable income highlight structural stresses beneath the headline numbers. Growth is still slow compared to pre-pandemic numbers. Streaming growth rates have shrunk compared with previous years, and industry insiders caution that continued momentum isn’t guaranteed without further innovation and support.

The Bigger Picture

The UK music market’s record spending in 2025 reflects both enduring consumer appetite and structural shifts in how music is consumed. Streaming is still king, but its explosive growth has moderated. On a more positive note, physical formats like vinyl are thriving again — driven by nostalgic and collectible appeal — and that’s helping artists offset the rising costs of touring with cash in their pockets at a desperate time. Lastly, revenue gains are often not evenly felt across the industry, and especially at the grassroots level.

For policymakers and industry leaders, these figures reinforce the need to balance commercial success with sustainable support for artists and the broader creative ecosystem — from independent venues to artist development programs.