_______________________________

Guest post by Ed Peto of OutdustryThis article, authored by Outdustry’s Ed Peto, originally appeared as a feature in the Music Ally Report on June 28th 2017. It represents the start of Ed’s Masters thesis research into the Indian music market for the Berlin School of Creative Leadership MBA. You can also see Ed curating/moderating the MIDEM 2017 India panel here (Music Ally write up here).

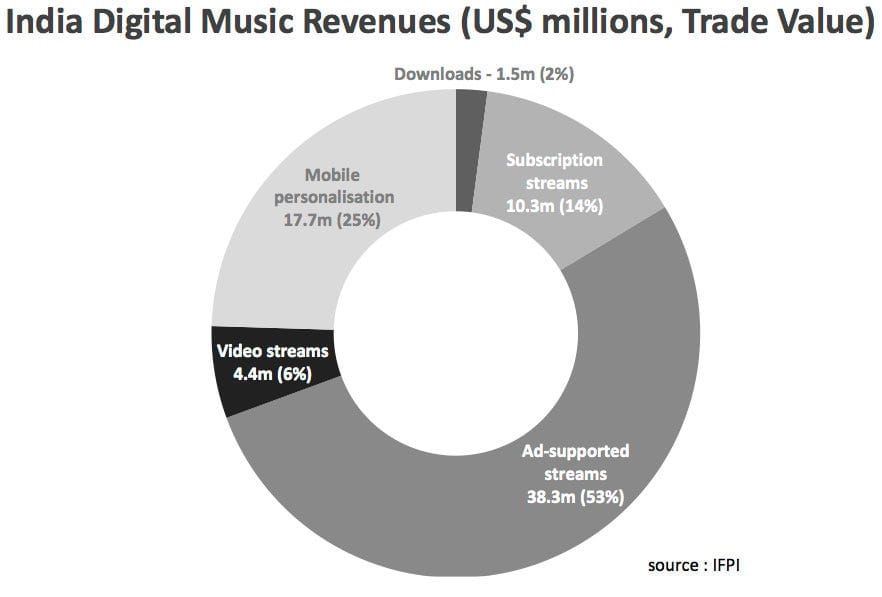

Saavn billboard, Mumbai (Ed Peto)The crucial figure is the US$10.3m (IFPI) in subscription revenues. At a typical subscription price point of US$1.5 (99INR)/month, this figure suggests significantly under 1 million subscribers in total across all DSP. In the coming years, as with everywhere else in the world, subscriptions are where the focus will be, although in the short term it is an incredibly tough sell. Since its 2008 launch in India, YouTube has become a catch-all platform for free content consumption — TV, film, music, UGC — earning it an audience of 180m MAU, meaning more than a third of the entire Indian internet user base of 460m visit the platform each month. Of late, however, major broadcasters and film studios have been removing their content and building standalone OTT offerings with the ultimate aim of monetising via subscriptions. As a music platform, though, YouTube is still where the vast majority of digital music consumption takes place as free video streams. Along side this, an estimated 78% of internet users have used stream-ripping software within the previous six months. In short, free access and free ownership are both assumed, with understandably slow progress being made in convincing users that more value lies behind a subscription paywall.

Saavn billboard, Mumbai (Ed Peto)The crucial figure is the US$10.3m (IFPI) in subscription revenues. At a typical subscription price point of US$1.5 (99INR)/month, this figure suggests significantly under 1 million subscribers in total across all DSP. In the coming years, as with everywhere else in the world, subscriptions are where the focus will be, although in the short term it is an incredibly tough sell. Since its 2008 launch in India, YouTube has become a catch-all platform for free content consumption — TV, film, music, UGC — earning it an audience of 180m MAU, meaning more than a third of the entire Indian internet user base of 460m visit the platform each month. Of late, however, major broadcasters and film studios have been removing their content and building standalone OTT offerings with the ultimate aim of monetising via subscriptions. As a music platform, though, YouTube is still where the vast majority of digital music consumption takes place as free video streams. Along side this, an estimated 78% of internet users have used stream-ripping software within the previous six months. In short, free access and free ownership are both assumed, with understandably slow progress being made in convincing users that more value lies behind a subscription paywall.

Related articles