________________________

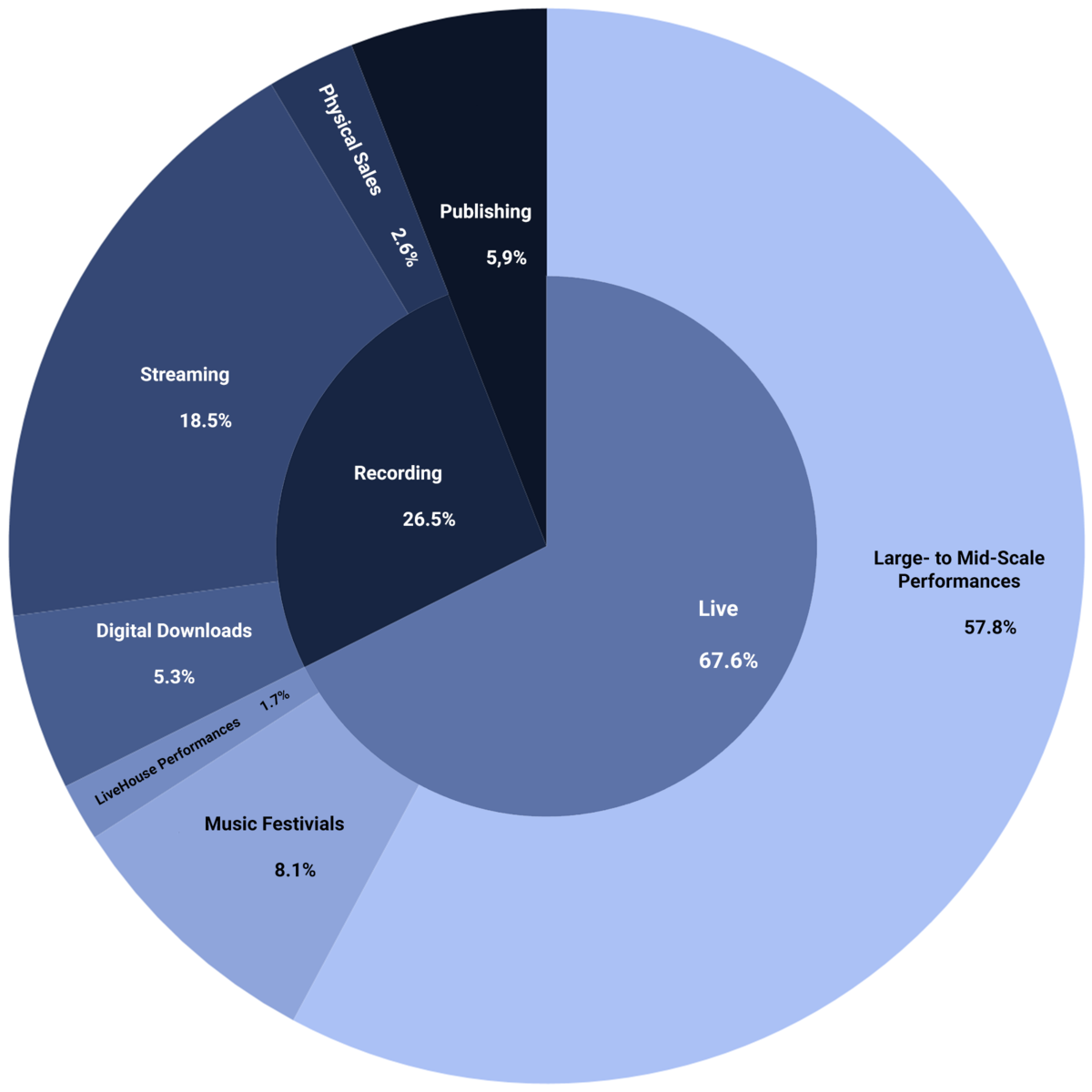

Guest post from the Soundcharts BlogThe music business in China is a rapidly developing, vibrant industry: in just two years, it went from 12th to 7th place in the IFPI global recording market rankings, and you wouldn't find such growth elsewhere in the world. However, what are the drivers of this development? Will the trend hold up in the future? China is one of the hottest topics in the industry right now, as music professionals all over the globe recognize the market's vast potential. However, if you would compare to traditional, western markets, you would probably find more differences than similarities. The music industry in China faced unique challenges — and developed equally unique solutions. That is why we've decided to take a deep dive, and tell you everything that you need to know about the music business in China.This article is the first chapter of our analysis, where we will explore the general structure of the market as well as the country's recording industry. The second chapter, where we get down to the live industry and the place of international artists in China, will follow shortly, so stay tuned for that — and if you want to make sure you won't miss it, follow Soundcharts on Twitter, where we share the articles we publish the moment they're out. So, without further ado, let's get into it. In line with the traditions of our Market Focus articles, we will start with a couple of key statistics across the main verticals of the local music business: Live, Recording and Publishing.Structure of the industry and key statistics:1. Live Industry- Live concerts generated $747 million in 2017, up 13% from the previous year

- The number of performances reached 15,5k, attracting 13.4 million viewers, with a year-on-year increase of 30% and 14%, accordingly

- Throughout 2017, solo concerts of international artists accounted for 11.8% of the total live revenues (excluding music festivals)

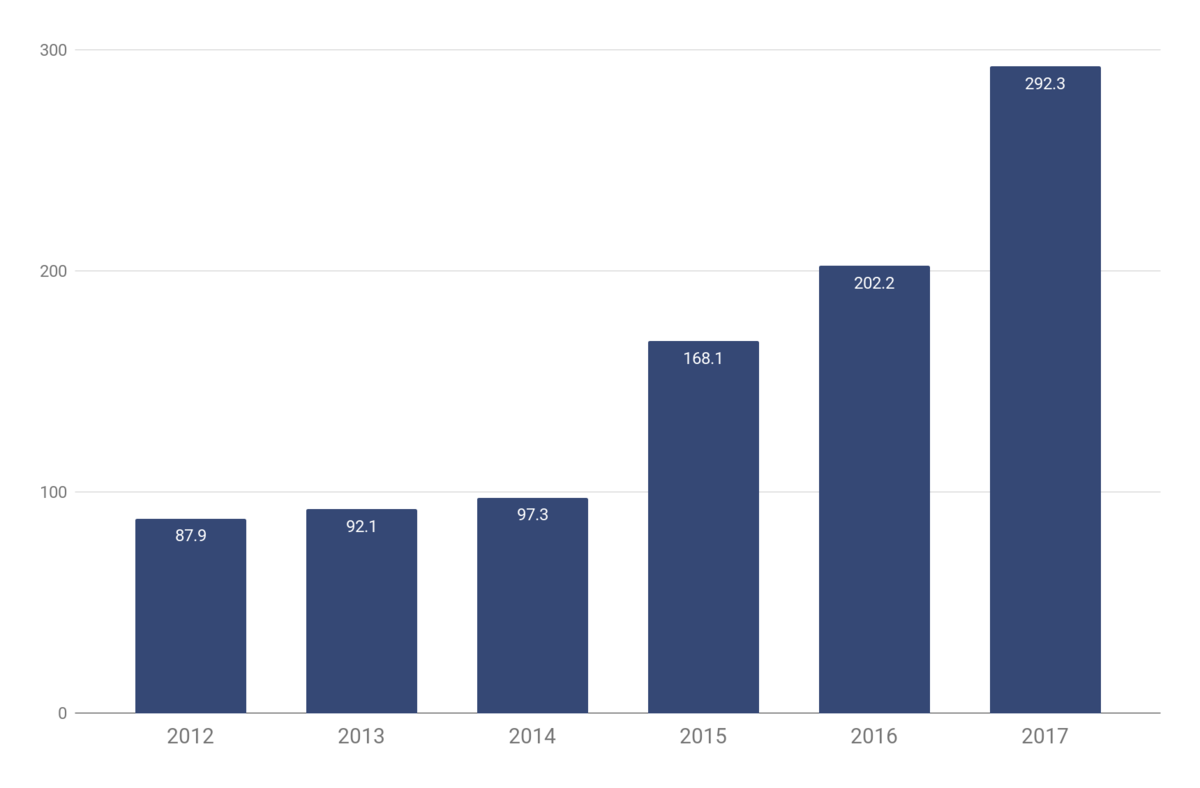

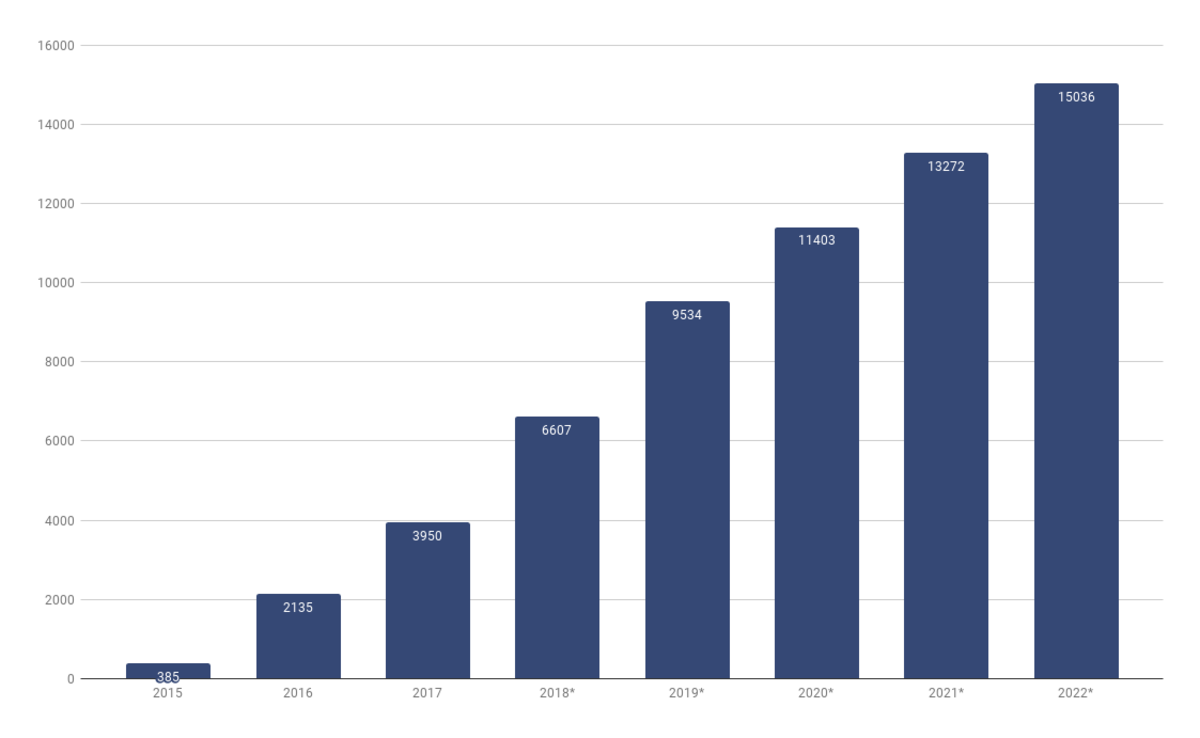

- According to IFPI data, recorded music sales generated $292.3 million in 2017, up 35.3% since 2016

- Around 70% of the recording revenues, or $205 million, was generated by steaming, while physical sales accounted for as little as 7%.

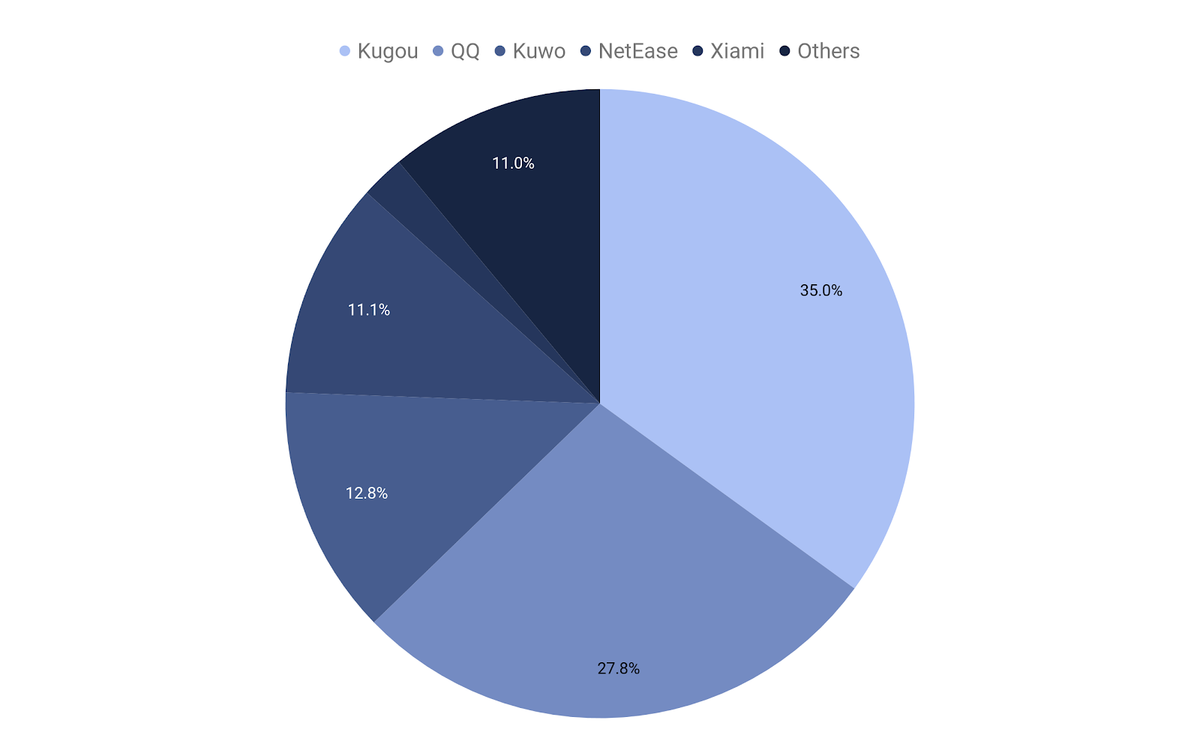

- In 2017, the number of DSPs’ users reached 523 million with the average subscription rate of about 4%

3. Publishing Industry:

- Publishing generated $65 million (Source 1, Source 2) in 2017, split halfway between the two copyright management bodies: MCSC, China’s only CMO and state-owned karaoke PRO, CAVCA

- The copyright enforcement remains problematic: reportedly, MCSC collects the royalties across less than 5% of broadcasters in China

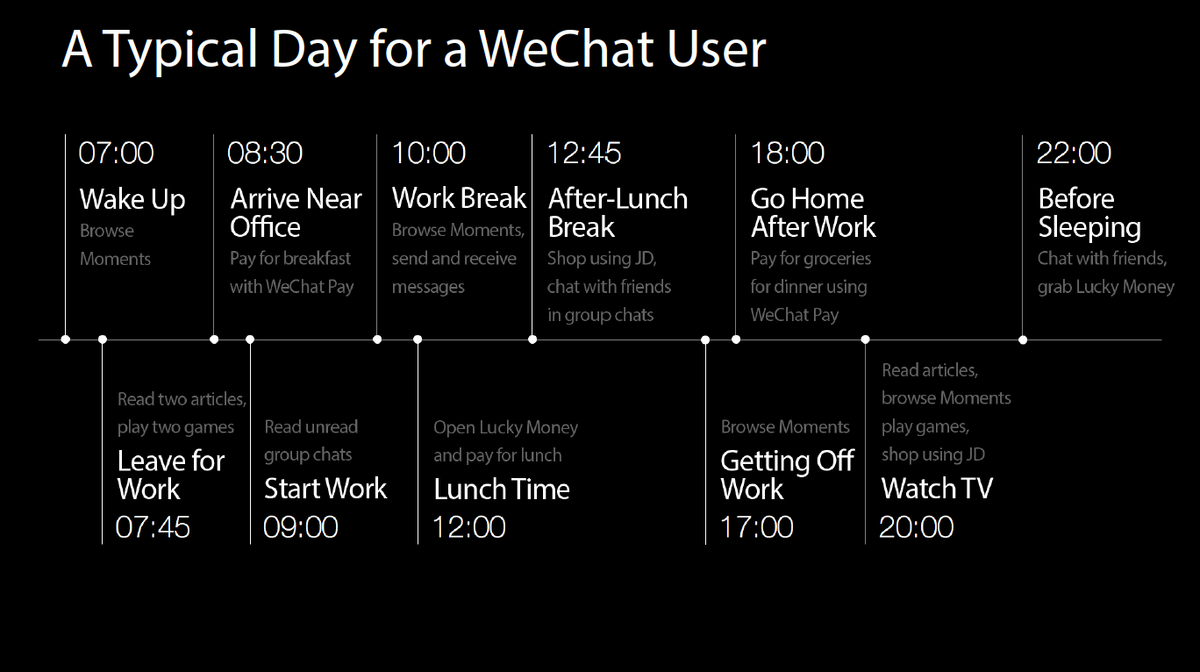

To understand what that means, we need to take a more in-depth look at the part of TME's portfolio that lies outside of the conventional music streaming. On top of the online music services mentioned before, Tencent Music also operates "music-centric live streaming services" KuGou Live and KuWo Live, and "online karaoke social community" WeSing. The live streaming services are pretty much self-explanatory: KuGou and KuWo Live allow artists to stream their live performances (imagine Twitch.tv, reserved exclusively for music-based content). WeSing, on the other hand, is a social-based karaoke app, tapping into the popularity of KTV in China (where karaoke is a $13 billion industry), allowing its users to share their covers with friends and followers.One way to make sense of that constellation of apps is to see it as an ecosystem. The streaming services are the backbone of it, bringing in new users, and the "side-services" of live streaming and karaoke are there to monetize that traffic. Such logic is often applied in the world of free-to-play games like Fortnite (Tencent holds a 40% stake since 2012 in Fortnite's developer EPIC Games, by the way). The free game is a traffic magnet, and that traffic is monetized by microtransactions: in-game cosmetic items and so on. TME's ecosystem works on the same principle — but its approach to microtransactions is deeply rooted in the Chinese culture itself.The basis of the live streaming industry in China is the "Red Envelope" tradition of gifting money to performers as a way of showing appreciation. If in the U.S. most of the revenues of Twitch are generated by ads and subscriptions, the Chinese live streaming market relies entirely on the virtual gifts and donations to streamers. That approach seems to yield great results, with live streaming in China growing at over 100% CAGR from 2012 to 2017.

The scope of the Music-Centric Social Entertainment Services

Not so long ago Coachella and YouTube made headlines, as the first weekend of U.S. festival broke the records by generating 82.9 million live views on the platform in the course of two days. Well, what if I tell you that the performances of Childish Gambino, BLACKPINK, Billie Eilish and alike, all combined still fall short of a single TFBOYSconcert, celebrating the four-year anniversary of the Chinese boys-band? The performance, live-streamed across all of the apps in Tencent's ecosystem, gathered, according to Tencent,a total of 118 million live views, peaking at 7.66 million concurrent viewers, with over 340 million virtual gifts sent out during the stream. The gifts are priced in a range from 0.05 to 1000+ RMB, and even if we assume the cost of an average donation at 0.5 RMB ($0.073), that would still make about $25,000,000 pie split between TME and TFBOYS — which is about as much as Ed Sheeran made in gross ticket sales over 4 nights at Wembley Stadium last year.

However, If a couple of years ago, the main word to describe the Chinese recorded music was "untapped potential", in 2019, it would be more like "somewhat-tapped potential". China is steadily climbing the IFPI revenue charts, landing on the 7th placein 2018; Financial Report for Q1 of 2019, recently released by TME shows some shifts in regards to premium subscriptions, with conversion rate bumping up to 4,3%. Just recently, the news broke out that China overtook the U.S. in terms of the smart speaker sales — and, as we know, smart speakers consumption tend to drive the sales of premium streaming subscriptions. In short, the Chinese recording industry starts to mature, but it hasn't reached the scope where middle-class artists can rely on music sales to pay the bills yet.So, while the penetration of free streaming made the recording industry the central customer-facing part of the business, artists have to rely on other sources of income to actually make the money. However, how do you monetize your music on the market where consumers are not used to paying for it? What is the landscape of the live industry, and what are the pitfalls of planning a tour in China? Find out on the second part of our analysis, where we get down to the country's rapidly developing live industry, and the opportunities of the Chinese concert market.Take me to the Analysis of the Chinese Live Industry