________________________

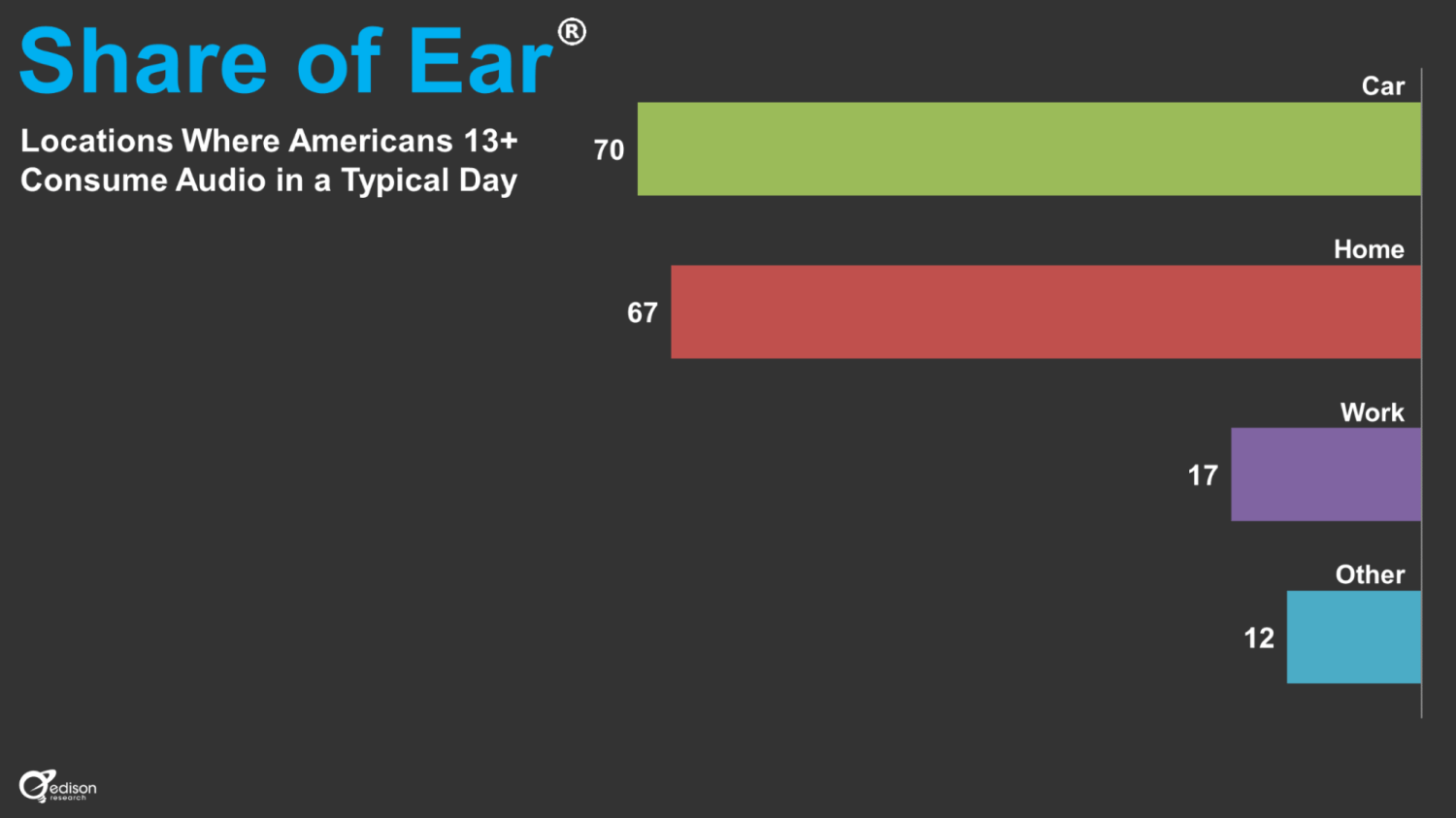

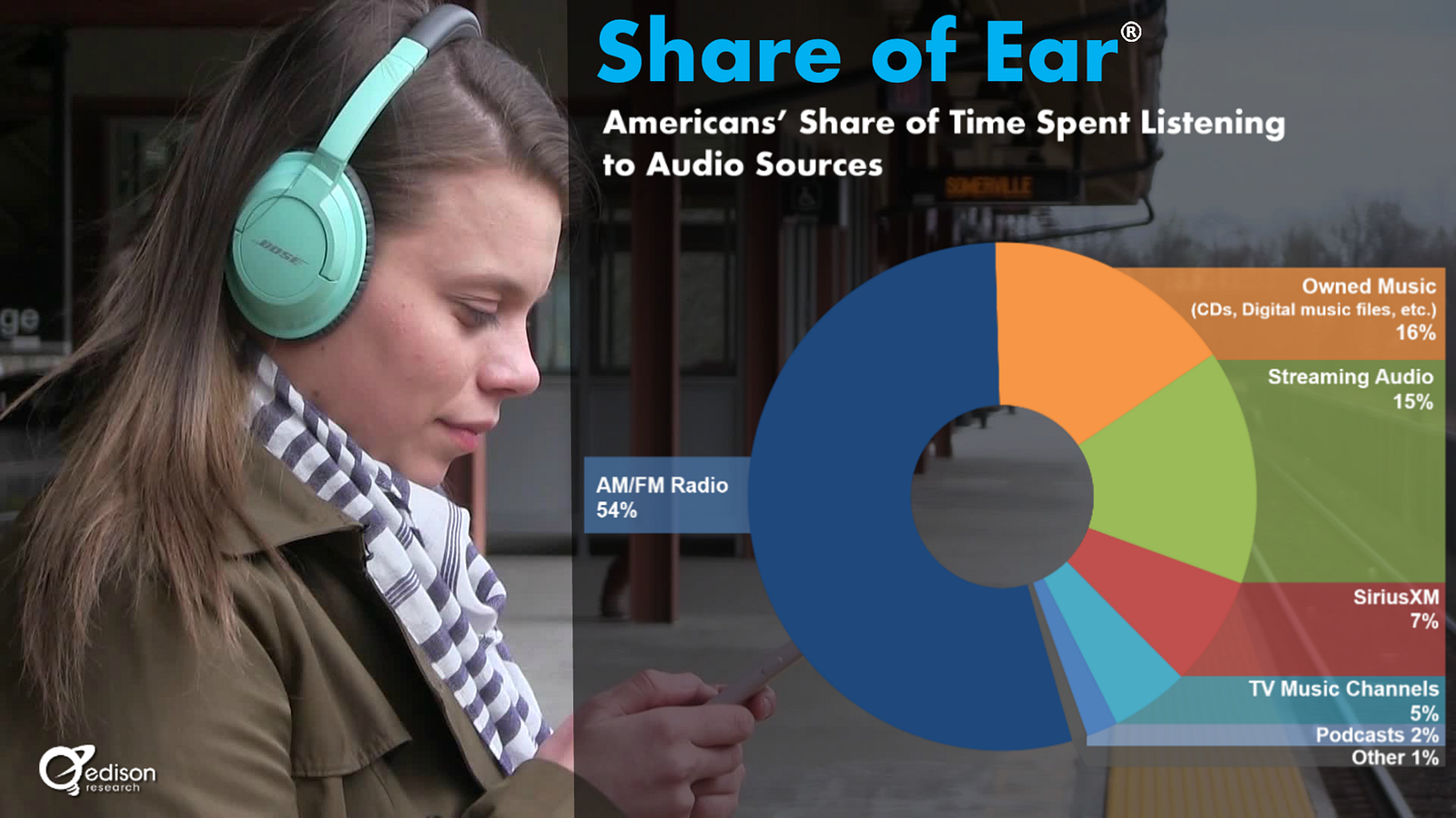

Guest post by Jason Joven of ChartMetricIf you’ve been in the music business for decades, you’ve seen it firsthand: household radio DJ voices giving way to nameless playlist curators. The leisurely FM frequency scan turning into direct, on-demand track selection. Radio promotion teams being turned into playlist pitching ones that more negotiate with mysterious computer algorithms than actual human beings.News continues to herald the inevitable: iHeartMedia (800+ stations, owner of Mediabase) filed for bankruptcy in March 2018, only months after US radio’s #2 owner/operator Cumulus Media (400+ stations) filed the same in November 2017; US radio continues to draw ire from the global radio community for its practice of paying zero recorded music royalties (also known as “neighboring rights”) to copyright owners, despite making billions in advertising revenue over decades ($15.9B in 2017 alone for traditional US radio ads). The only other non-Rome Convention countries to act similarly: Rwanda, North Korea, Iran, China. Most recently in September 2018, Sirius XM agreed to purchase Pandora Media to the tune of $3B USD, saying something about radio’s reluctant agreement that digital streaming is indeed the future.Yet in America, record labels are willing to spend $200K-700K+ to break a new artist in a major radio market, according to the IFPI.Why? Americans LOVE cars.

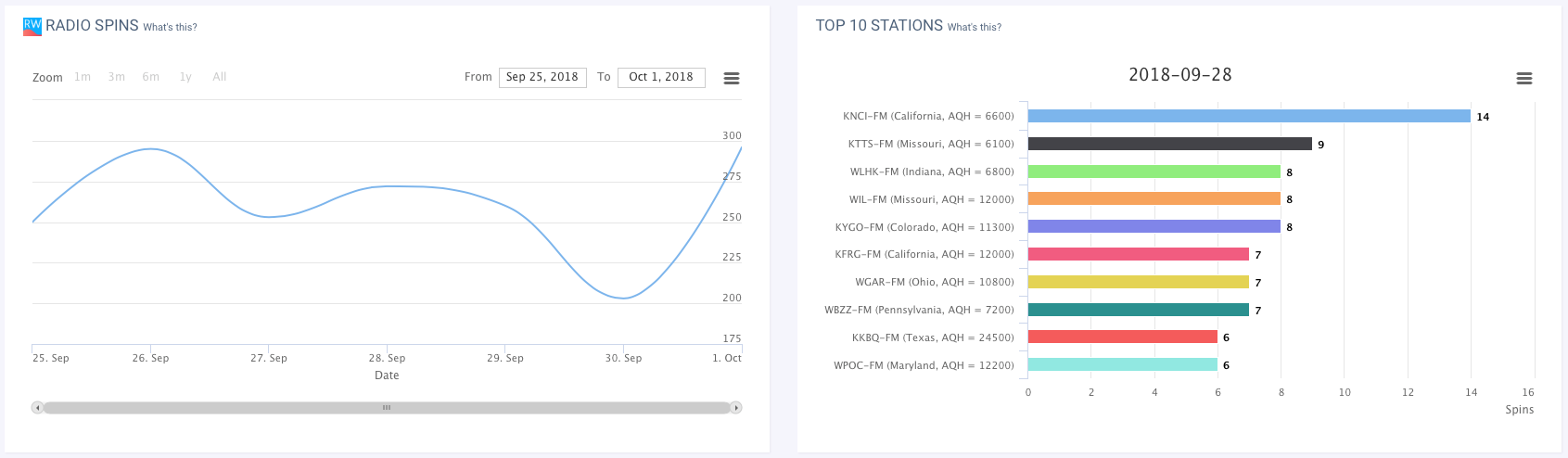

Chartmetric Oct 2018 Update → Radio Spins from RadioWave’s Top 300

While Chartmetric strives to stay ahead of the music analytics curve, we also acknowledge where music’s been and how radio still plays a major role in breaking new artists in the United States. So we’re excited to present our new Radio AirPlay data in all Chartmetric artist/track/album profiles that have terrestrial (plus select satellite/Internet) radio spins in our dataset.While iHeartMedia’s Mediabase has been an industry standard for monitoring US radio airplay, we’d like to present an easy-to-access tool that sits right alongside the rest of our Chartmetric visualizations. While Mediabase offers a great library of stations, we want to offer a more focused dataset we’re calling the “RadioWave Top 300".

Selecting the RadioWave Top 300 stations

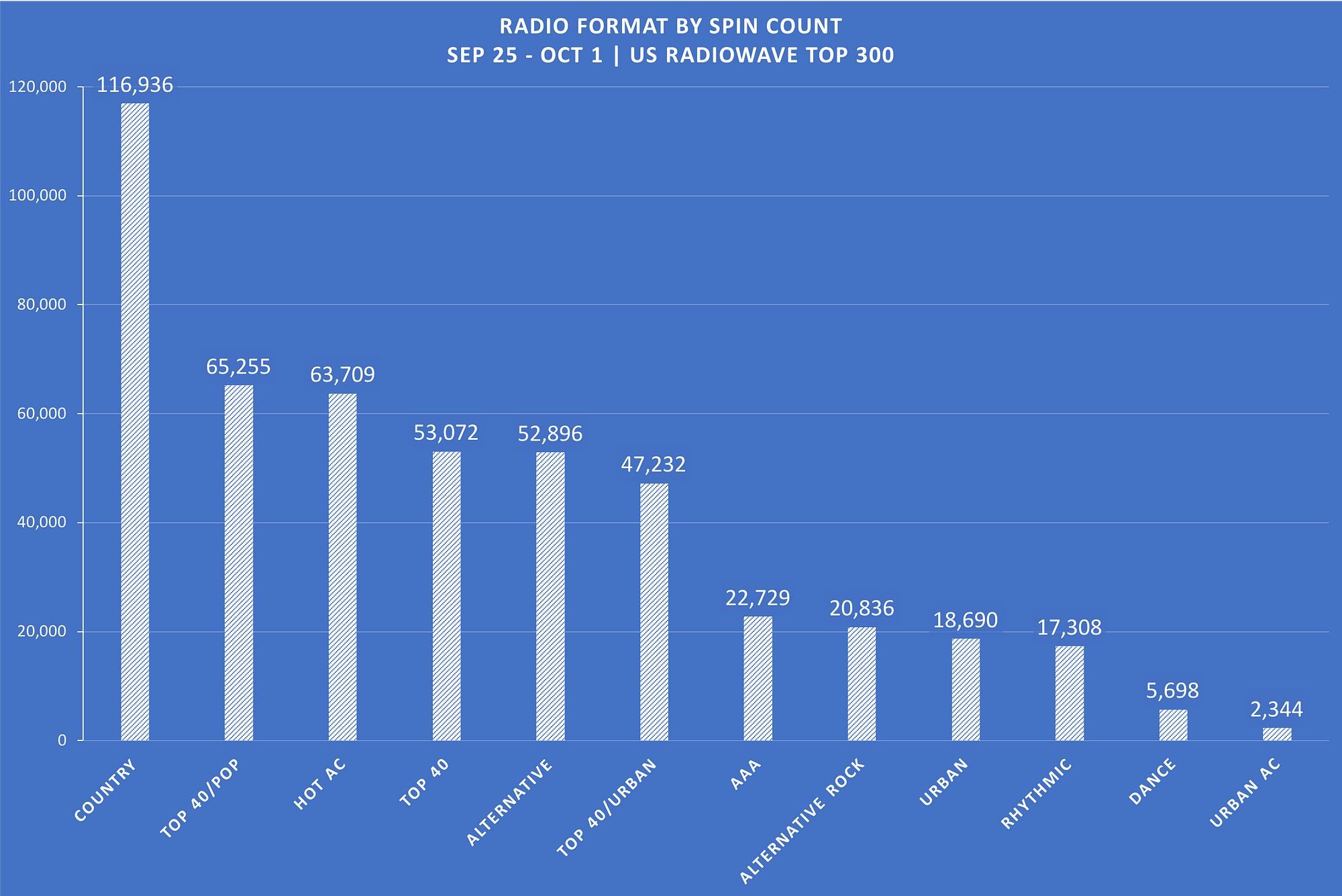

The RadioWave team, led by Seth Keller, worked with us to fine-tune the panel of 300 radio stations, optimizing for the latest new releases from both popular and emerging artists that span the various forms of pop, hip-hop, rock, and country. Essentially, this panel plays what the Chartmetric client base is most concerned about. The radio formats we focus on:- AAA: Adult Album Alternative, or “Triple A”; critically-acclaimed music and singer-songwriters, released mostly by independent labels; a smaller format

- Alternative: Alternative rock; historically, the format started in the West and remains influential there, weaker in the South

- Country: Plays biggest in the South as expected, but a presence nationwide; by far, the #1 format within our dataset this week (see format table above)

- Dance: Skews digital (e.g. SoundCloud, YouTube), but Sirius XM does remain a significant influence in this space; the few American stations that do broadcast here can still show early indicators of trends that eventually move into the Top 40 format

- Hot AC: Hot Adult Contemporary; primarily months-old Top 40 hits, of most concern to major label frontline teams and the catalog teams that will soon inherit them

- Rhythmic: Plays bigger in the West; a mix of Top 40 and Urban where R&B, dance, hip-hop, pop co-exist

- Top 40: Contemporary Hit Radio, or “CHR”; what you’d expect, the latest and greatest from mostly major labels

- Urban: Plays more in the Midwest/South/East; hip-hop and rap

Brief RadioWave Top 300 Overview

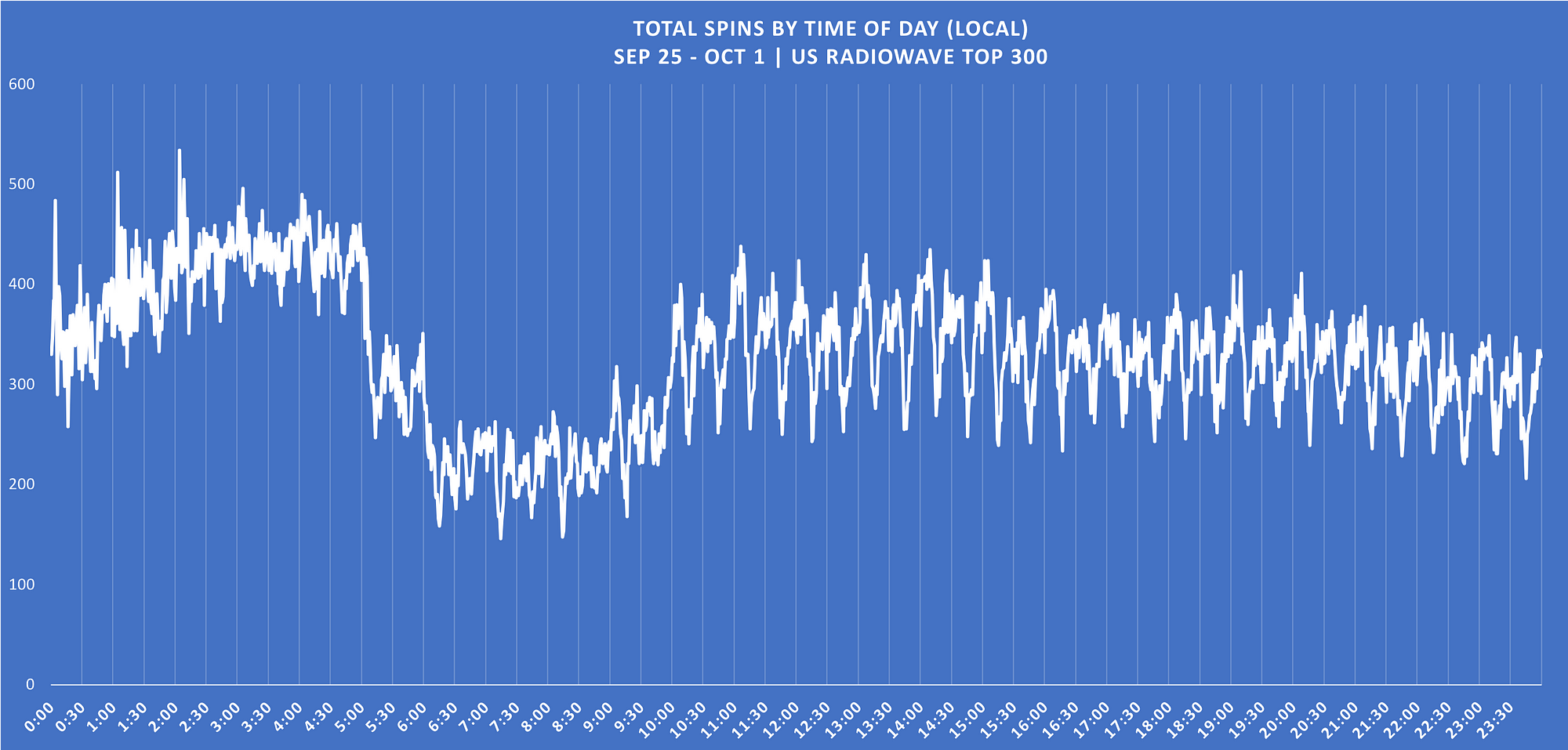

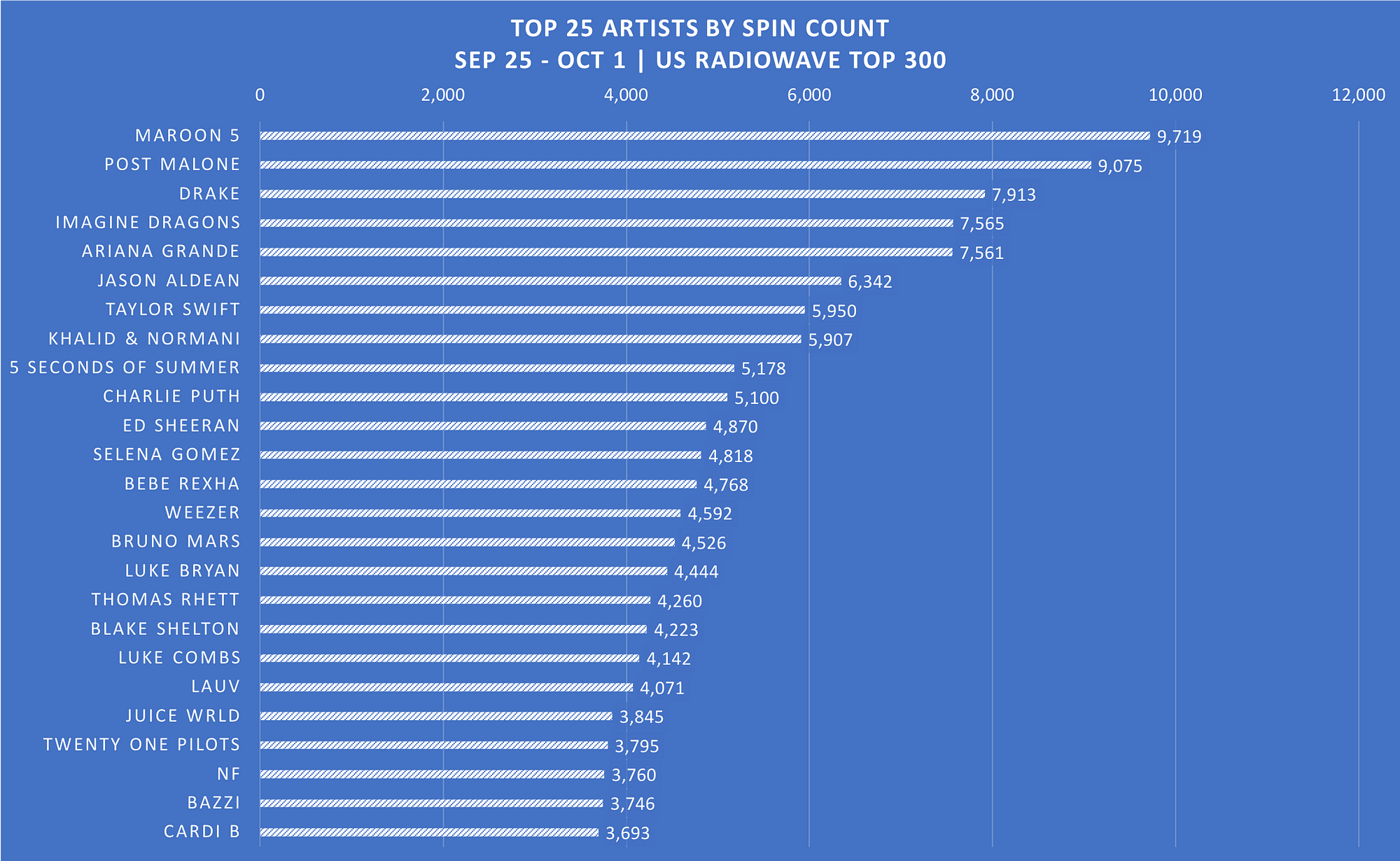

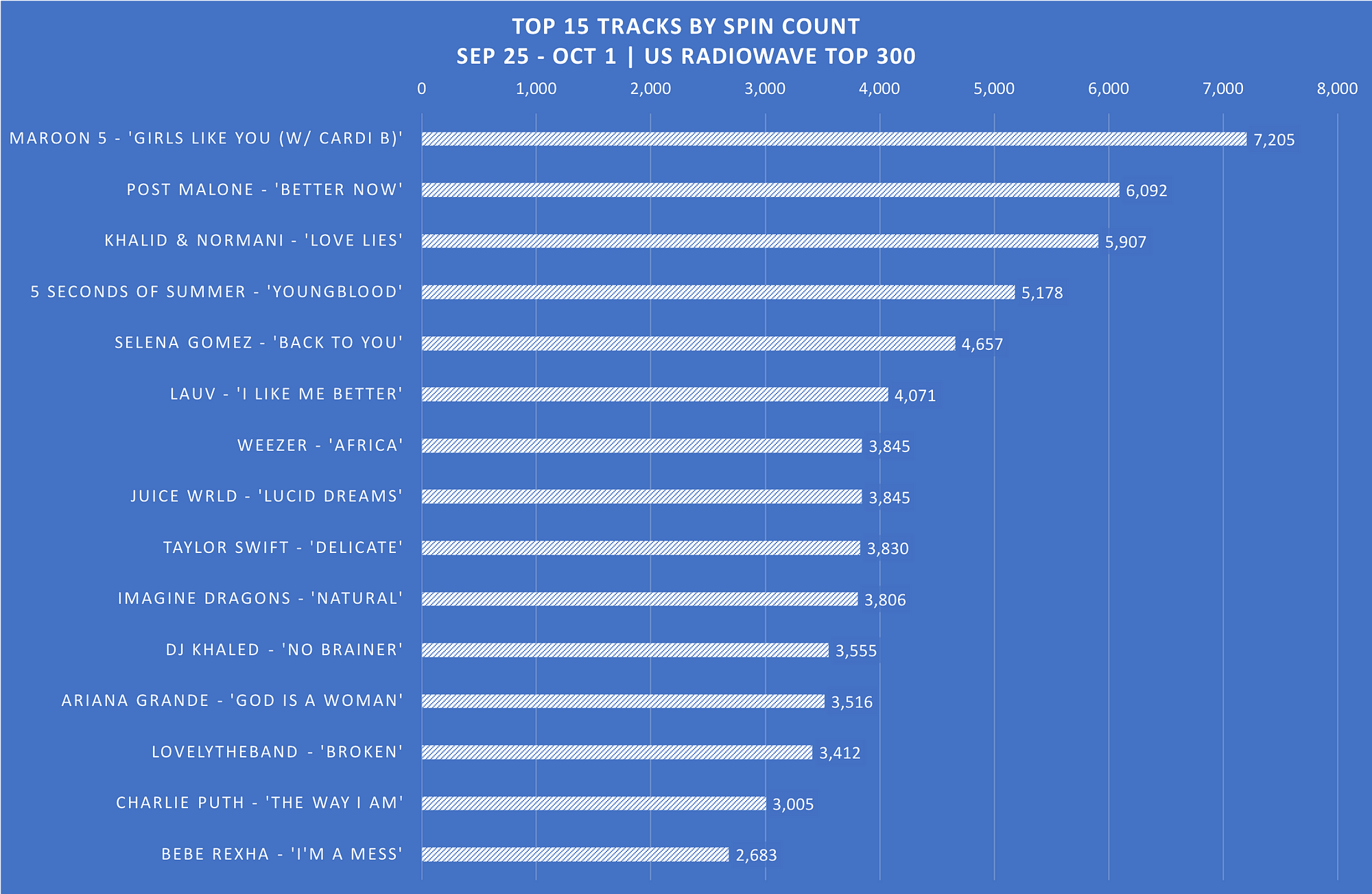

Aggregating all the tracks played in the past week (Sept 25-Oct 1 2018), Maroon 5 and Post Malone are riding high on “Girls Like You” and “Better Now”, respectively. Interestingly, Drake pulls in at #3 despite having no tracks in the Top 15 this past week, but in another way, it shows how deep his repertoire is by not having to rely on any one single to still achieve such radio play stateside.Despite having the most spins by format, the most spun country artist is Jason Aldean, sliding in at the #6 spot (6.3K), with Luke Bryan (4.4K), Thomas Rhett (4.2K), Blake Shelton (4.2K) and Luke Combs (4.1K) playing strong support roles at #16–19. As a genre, country is showing itself to also have a deep roster of heavy hitters to call upon.

Chartmetric Radio AirPlay Interface

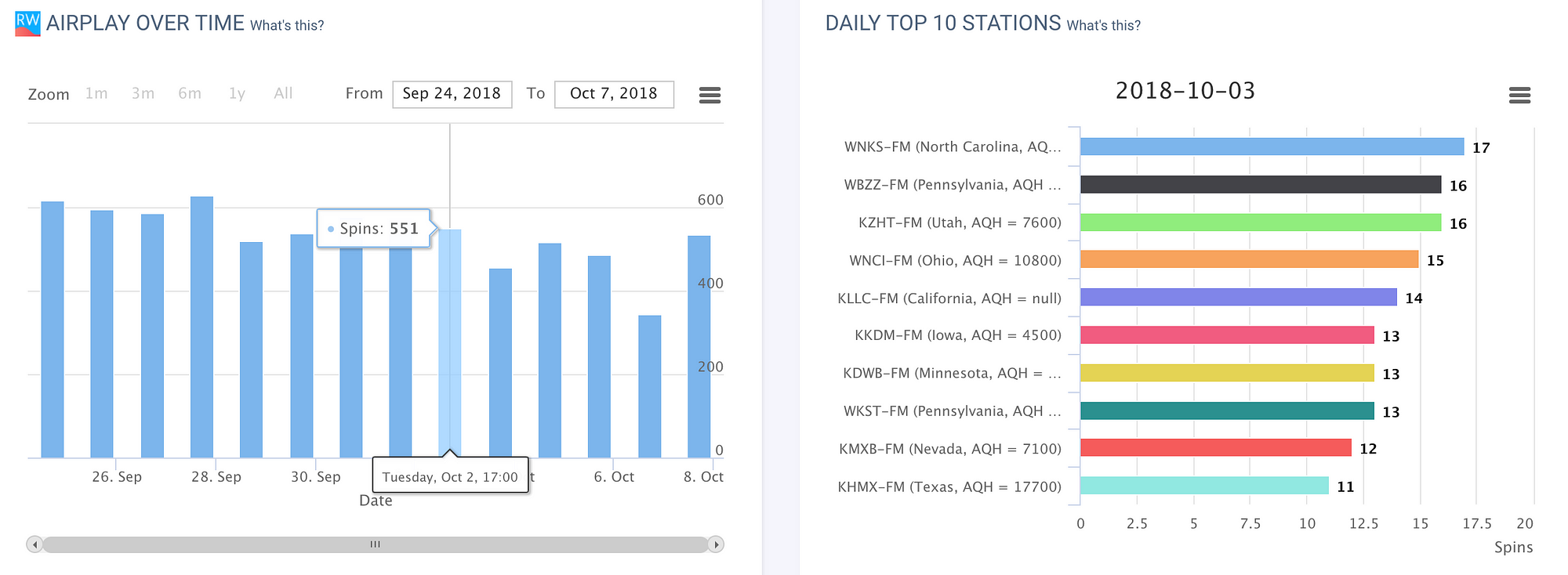

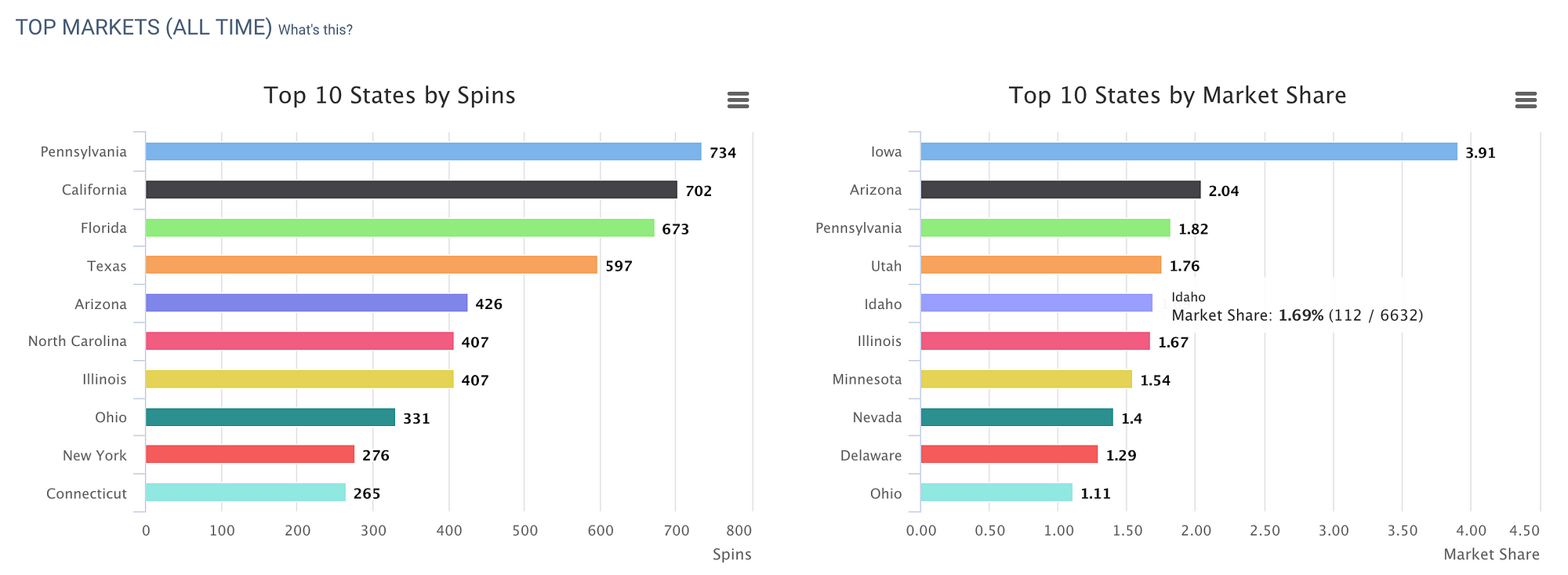

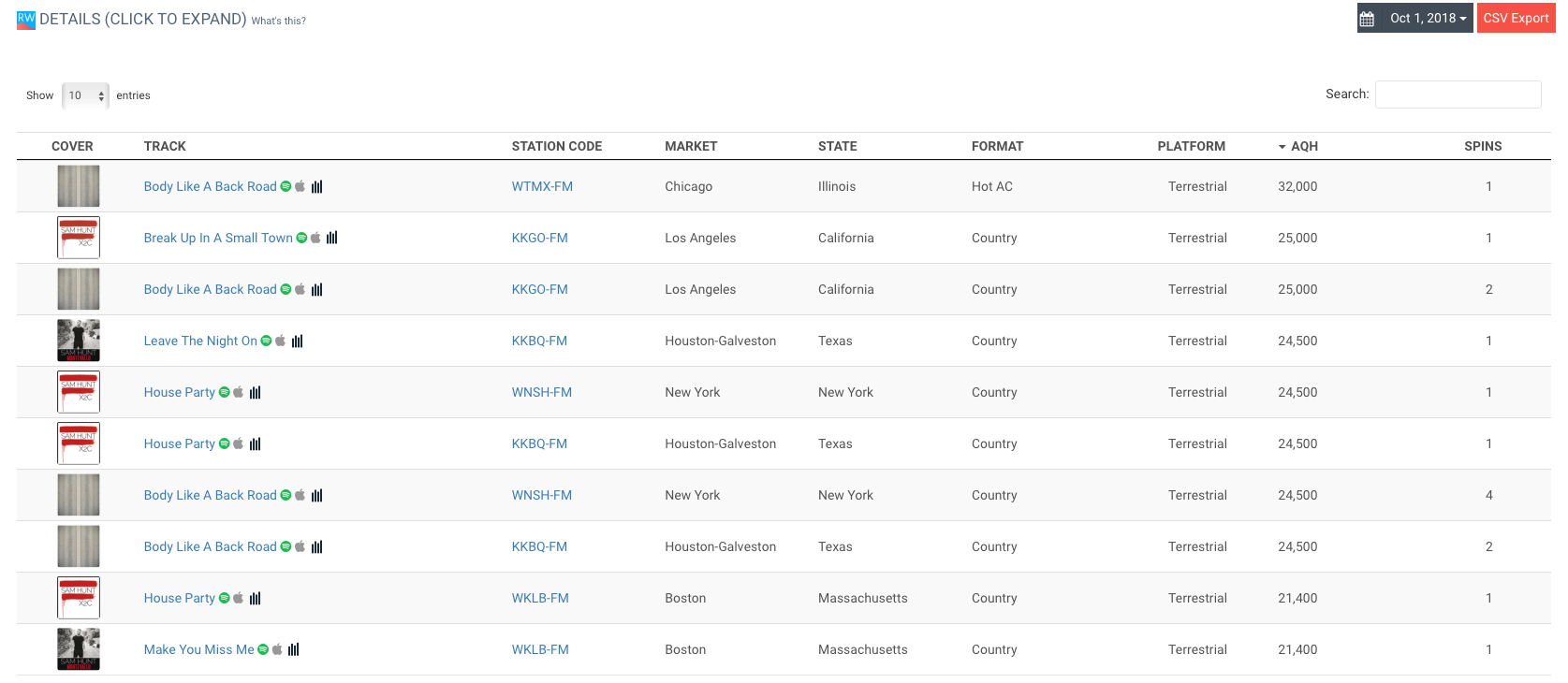

Our first AirPlay charts function much like our Spotify Playlist Evolution ones, in which you can scroll over the aggregate amount of spins on the left line chart over your chosen timeframe (for now, only a week but this will grow) and the right bar chart will dynamically show the top 10 US stations by spins.

Streaming Hasn’t Killed The Radio Star

As Spotify, Apple Music, Google/YouTube, QQ Music, JioMusic-Saavn and countless global players battle over the world’s streaming market…let’s not forget about US radio. Many of us have grown used to (or simply grown up with) thinking “1 play = 1 person”, but with traditional radio, it’s more 1 play for the radio station’s cumulative market listeners, potentially. One radio spincan potentially equal thousands of listeners, so it’s important for us to think differently vice the extremely personal streaming world.As of IFPI’s 2018 Global Music Report, America remains the #1 music market worldwide, and if your artist wants to break into mainstream US, radio still must be a big piece of your strategy. So while you make master plans with the new Airplay dataset, we’ll continue to find new ways to help you connect with your fans, quickly and accurately.Apparently, video didn’t kill the radio star…and so far, neither has streaming.Have any thoughts about radio data? Shoot us a message at hi (at) chartmetric (dot) io!